Medical Professionals Aided CIA Torture, Area 51 Witnesses, Nanothermite in 9/11 Dust

Revealing News Articles

April 13, 2009

Dear friends,

Below are key excerpts of important news articles you may have missed. These news articles include revealing information on the suppressed report from the Red Cross on extensive involvement of medical professionals in the CIA torture in secret prisons worldwide, the testimony of top military witnesses to the existence of Area 51, the discovery by a team of scientists of a highly-explosive nanothermite compound in the collapse of buildings from the WTC on 9/11, and more. Each excerpt is taken verbatim from the major media website listed at the link provided. If any link fails to function, click here. Key sentences are highlighted for those with limited time. By choosing to educate ourselves and to spread the word, we can and will build a brighter future.

With best wishes,

Tod Fletcher and Fred Burks for PEERS and WantToKnow.info

Report Outlines Medical Workers' Role in Torture

April 7, 2009, New York Times

http://www.nytimes.com/2009/04/07/world/07detain.html

Medical personnel were deeply involved in the abusive interrogation of terrorist suspects held overseas by the Central Intelligence Agency, including torture, and their participation was a "gross breach of medical ethics," a long-secret report by the International Committee of the Red Cross concluded. Based on statements by 14 prisoners who belonged to Al Qaeda and were moved to Guantanamo Bay, Cuba, in late 2006, Red Cross investigators concluded that medical professionals working for the C.I.A. monitored prisoners undergoing waterboarding, apparently to make sure they did not drown. Medical workers were also present when guards confined prisoners in small boxes, shackled their arms to the ceiling, kept them in frigid cells and slammed them repeatedly into walls, the report said. Facilitating such practices, which the Red Cross described as torture, was a violation of medical ethics even if the medical workers' intentions had been to prevent death or permanent injury, the report said. But it found that the medical professionals' role was primarily to support the interrogators, not to protect the prisoners, and that the professionals had "condoned and participated in ill treatment." At times, according to the detainees' accounts, medical workers "gave instructions to interrogators to continue, to adjust or to stop particular methods." The Red Cross report was completed in 2007. It was obtained by Mark Danner, a journalist who has written extensively about torture, and posted Monday night with an article by Mr. Danner on the Web site of The New York Review of Books.

Note: Much of content of the Red Cross report was revealed in a March article by Mr. Danner and in a 2008 book, The Dark Side, by Jane Mayer, but the reporting of the Red Cross investigators' conclusions on medical ethics and other issues are new.

The Road to Area 51

April 5, 2009, Los Angeles Times

http://www.latimes.com/la-mag-april052009-backstory,0,786384.story

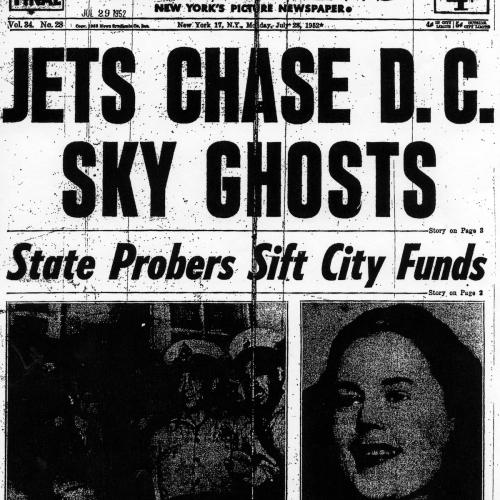

Area 51. It's the most famous military institution in the world that doesn't officially exist. If it did, it would be found about 100 miles outside Las Vegas in Nevada's high desert. Then again, maybe not – the U.S. government refuses to say. You can't drive anywhere close to it, and until recently, the airspace overhead was restricted – all the way to outer space. Any mention of Area 51 gets redacted from official documents, even those that have been declassified for decades. It has become the holy grail for conspiracy theorists, with UFOlogists positing that the Pentagon reverse engineers flying saucers and keeps extraterrestrial beings stored in freezers. Urban legend has it that Area 51 is connected by underground tunnels and trains to other secret facilities around the country. Well, now, for the first time, someone is ready to talk – in fact, five men are, and their stories rival the most outrageous of rumors. Colonel Hugh "Slip" Slater, 87, was commander of the Area 51 base in the 1960s. Edward Lovick, 90, ... spent three decades radar testing some of the world's most famous aircraft. Kenneth Collins, 80, a CIA experimental test pilot, was given the silver star. Thornton "T.D." Barnes, 72, was an Area 51 special-projects engineer. And Harry Martin, 77, was one of the men in charge of the base's half-million-gallon monthly supply of spy-plane fuels. As for the underground-tunnel talk ... Barnes worked on a nuclear-rocket program ... in Area 51's backyard. "Three test-cell facilities were connected by railroad, but everything else was underground," he says.

Note: So the government has been lying to us for 50 years about Area 51 and underground research there. What else are they lying to us about? For a more powerful, incisive article on this development, click here. And why isn't this getting more coverage? For another report showing major media cover-up of UFOs, click here.

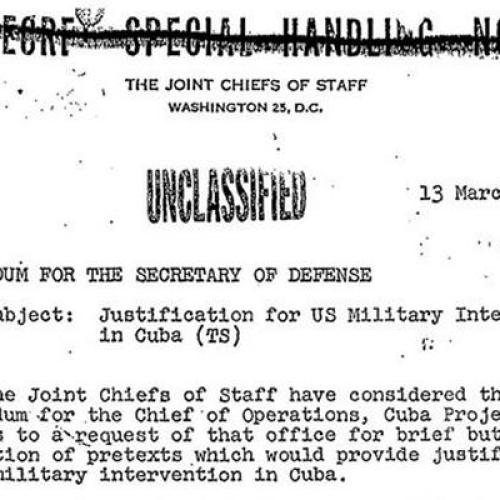

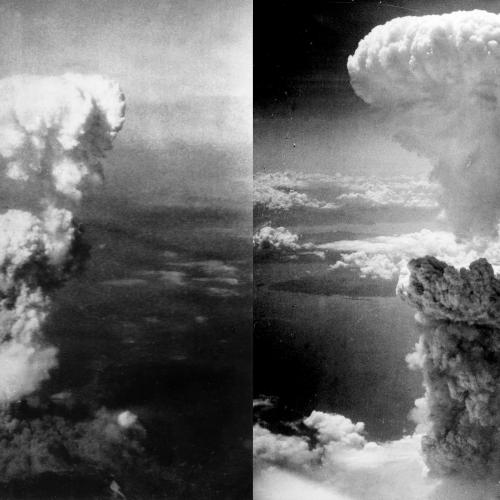

Traces of explosives in 9/11 dust, scientists say

April 6, 2009, Deseret News (One of Salt Lake City's leading newspapers)

http://www.deseretnews.com/article/0,5143,705295677,00.html

Tiny red and gray chips found in the dust from the collapse of the World Trade Center contain highly explosive materials – proof, according to a former BYU professor, that 9/11 is still a sinister mystery. Physicist Steven E. Jones, who retired from Brigham Young University in 2006 after the school recoiled from the controversy surrounding his 9/11 theories, is one of nine authors on a paper published last week in the online, peer-reviewed Open Chemical Physics Journal. Also listed as authors are BYU physics professor Jeffrey Farrer and a professor of nanochemistry at the University of Copenhagen in Denmark. For several years, Jones has theorized that pre-positioned explosives, not fires from jet fuel, caused the rapid, symmetrical collapse of the two World Trade Center buildings, plus the collapse of a third building, WTC-7. The newest research, according to the journal authors, shows that dust from the collapsing towers contained a "nano-thermite" material that is highly explosive. A layer of dust lay over parts of Manhattan immediately following the collapse of the towers, and it was samples of this dust that Jones and fellow researchers requested in a 2006 paper, hoping to determine "the whole truth of the events of that day." They eventually tested four samples they received from New Yorkers. Red/gray chips ... were found in all four dust samples. The chips were then analyzed using scanning electron microscopy and other high-tech tools. The red layer of the chips, according to the researchers, contains a "highly energetic" form of thermite.

Note: For the full text of this path-breaking scientific report, click here. Note that other major media failed to pick up this important news, though you can watch a Dutch news report (with English subtitles) on YouTube available here. For more key reports on the cutting-edge research of Prof. Steven Jones, click here.

Fifth Alarm for That Haunted Fireman

April 5, 2009, New York Times

http://www.nytimes.com/2009/04/05/arts/television/05harr.html

In Season 5 of "Rescue Me," which begins Tuesday on FX, the specter of 9/11 becomes a major character once again, when a French journalist starts interviewing firefighters about their experiences for a commemorative book. This season one major character will become seriously ill with cancer apparently caused by his work at ground zero. Another, Franco Rivera (Daniel Sunjata), will articulate his ... belief that 9/11 was "an inside job," the result of "a massive neoconservative government conspiracy" that was designed to increase American power by creating a pretext for seizing control of the world's oil supplies – a view Mr. Sunjata himself happens to share. "The reason we wrote it," Mr. Tolan said, "is that Danny was spouting this stuff and even some of the guys, the firefighters on the set, were saying 'What is this?' We saw how divisive this was and thought: We have to do this." Mr. Sunjata admits to some trepidation about how the show's audience will react to the story line. "I won't say that my opinions were warmly received on the set," he said. "At one point I thought, 'Maybe I'll get fired if I keep opening my mouth.' But even though Peter and Denis didn't sign on to this conspiracy, they were brave enough to include it in the show. I give them and FX and Fox – I never thought I'd say this – a big round of applause." Mr. Sunjata certainly had reason to fear losing his job, since "Rescue Me" has never been timid about dispatching major characters.

Note: To read why hundreds of professors and professionals agree with Daniel Sunjata, click here and here.

'No-Risk' Insurance at F.D.I.C.

April 7, 2009, New York Times

http://www.nytimes.com/2009/04/07/business/07sorkin.html

The Federal Deposit Insurance Corporation was set up 76 years ago with the important but simple job of insuring bank deposits. Now, because of what could politely be called mission creep, it's elbowing its way into the middle of the financial mess as an enabler of enormous leverage. In the fine print of Treasury Secretary Timothy F. Geithner's plan to lend as much as $1 trillion to private investors to help them buy toxic assets from our nation's banks, you'll find some details of how the F.D.I.C is trying to stabilize the system by adding more risk, not less, to the system. It's going to be insuring 85 percent of the debt, provided by the Treasury, that private investors will use to subsidize their acquisitions of toxic assets. These loans, while controversial, were given a warm welcome by the market when they were first announced. And why not? The terms are hard to beat. They are, for example, "nonrecourse," which means that if an investor loses money, he owes taxpayers nothing. It's the closest thing to risk-free investing – with leverage! – around. But, as we've learned the hard way these last couple of years, risk-free investing is an oxymoron. So where did the risk go this time? To the F.D.I.C., and ultimately, to us taxpayers. A close reading of the F.D.I.C.'s statute suggests the agency is using a unique – some might call it plain wrong – reading of its own rule book to accomplish this high-wire act. Somehow, in the name of solving the financial crisis, the F.D.I.C. has seemingly been given a blank check, with virtually no oversight by Congress.

Note: For a powerfully revealing archive of reports from reliable sources on the hidden realities of the financial bailout, click here.

U.S. May Enlist Small Investors in Bank Bailout

April 9, 2009, New York Times

http://www.nytimes.com/2009/04/09/business/09fund.html

During World War I, Americans were exhorted to buy Liberty Bonds to help their soldiers on the front. Now, it seems, they will be asked to come to the aid of their banks – with the added inducement of possibly making some money for themselves. As part of its sweeping plan to purge banks of troublesome assets, the Obama administration is encouraging several large investment companies to create the financial-crisis equivalent of war bonds: bailout funds. The idea is that these investments, akin to mutual funds that buy stocks and bonds, would give ordinary Americans a chance to profit from the bailouts that are being financed by their tax dollars. But there is another, deeply political motivation as well: to quiet accusations that all of these giant bailouts will benefit only Wall Street plutocrats. If, as some analysts suspect, the banks' assets are worth even less than believed, the funds' investors could suffer significant losses. Nonetheless, the administration and executives in the financial industry are pushing to establish the investment funds, in part to counter swelling hostility against the financial industry. The embrace of smaller investors underscores the concern in Washington and on Wall Street that Americans' anger could imperil further efforts to stimulate the economy with vast amounts of government spending. Many Americans say they believe the bailout programs ... will benefit only a golden few, including some of the institutions that helped push the economy to the brink. Critics like Joseph E. Stiglitz, a Nobel Prize-winning economist, argue that the bailouts merely privatize profits and socialize losses.

Note: For a powerfully revealing archive of reports from reliable sources on the hidden realities of the financial bailout, click here.

Why Creditors Should Suffer, Too

April 5, 2009, New York Times

http://www.nytimes.com/2009/04/05/business/economy/05view.html

The Obama administration's proposals to reform financial regulation sound ambitious enough as they aim to bring companies like A.I.G. under a broader umbrella of government rule-making and scrutiny. But there is a big hole in these proposals, as there has already been in the government's approach to bailing out failing financial companies. Even as they focus on firms deemed too big to fail, the new proposals immunize the creditors and counterparties of such firms by protecting them from their own lending and trading mistakes. This pattern has been evident for months, with the government aiding creditors and counterparties every step of the way. Yet this has not been explained openly to the American public. In truth, it's not the shareholders of the American International Group who benefited most from its bailout; they were mostly wiped out. The great beneficiaries have been the creditors and counterparties at the other end of A.I.G.'s derivatives deals – firms like Goldman Sachs, Merrill Lynch, Deutsche Bank, Société Générale, Barclays and UBS. These firms engaged in deals that A.I.G. could not make good on. The bailout, and the regulatory regime outlined by Timothy F. Geithner, the Treasury secretary, would give firms like these every incentive to make similar deals down the road. In both the bailouts and in the new proposals, the government is effectively neutralizing creditors as a force for financial safety. This suggests a scary possibility – that the next regulatory regime could end up even worse than the last.

Note: For a powerfully revealing archive of reports from reliable sources on the hidden realities of the financial bailout, click here.

Revelations of the wholesale greed and blatant transgressions of Wall Street

April 3, 2009, PBS Bill Moyers Journal

http://www.pbs.org/moyers/journal/04032009/transcript1.html

BILL MOYERS: For months now, revelations of the wholesale greed and blatant transgressions of Wall Street have reminded us that "The Best Way to Rob a Bank Is to Own One." In fact, the man you're about to meet wrote a book with just that title. Bill Black, ... what's your definition of fraud? WILLIAM K. BLACK: Fraud is deceit. And the essence of fraud is, "I create trust in you, and then I betray that trust, and get you to give me something of value." And as a result, there's no more effective acid against trust than fraud, especially fraud by top elites, and that's what we have. Well, The way that you do it is to make really bad loans, because they pay better. Then you grow extremely rapidly, in other words, you're a Ponzi-like scheme. And the third thing you do is we call it leverage. That just means borrowing a lot of money, and the combination creates a situation where you have guaranteed record profits in the early years. That makes you rich, through the bonuses that modern executive compensation has produced. It also makes it inevitable that there's going to be a disaster down the road. BILL MOYERS: So you're ... saying that CEOs of some of these banks and mortgage firms in order to increase their own personal income, deliberately set out to make bad loans? WILLIAM K. BLACK: Yes. BILL MOYERS: If I wanted to go looking for the parties to this, with a good bird dog, where would you send me? WILLIAM K. BLACK: Well, that's exactly what hasn't happened. We haven't looked, all right? You'd look at the specialty lenders. The lenders that did almost all of their work in the sub-prime and what's called Alt-A, liars' loans.

Note: William K. Black is the former senior regulator who cracked down on banks during the savings and loan crisis of the 1980s. He is now an Associate Professor of Economics and Law at the University of Missouri. The video of this fascinating interview is available here. For a powerfully revealing archive of reports from reliable sources on the hidden realities of the financial bailout, click here.

Latest CIA Scandal Puts Focus on How Agency Polices Self

March 20, 2009, Washington Post

http://www.washingtonpost.com/wp-dyn/content/article/2009/03/19/AR2009031904134.html

As a novice CIA case officer in the Middle East, Andrew Warren quickly learned the value of sex in recruiting spies. Colleagues say that he made an early habit of taking informants to strip clubs, and that he later began arranging out-of-town visits to brothels for his best recruits. Often Warren would travel with them, according to two colleagues who worked with him for years. His methods earned him promotions and notoriety over a lengthy career, until Warren, 41, became ensnared in a sex scandal. Two Algerian women have accused the Virginia native of drugging and sexually assaulting them, and, in one instance, videotaping the encounter. The episode -- one of three sex-related scandals to shake the CIA this year -- has drawn harsh questions from Congress about whether the agency adequately polices its far-flung workforce or takes sufficient steps to root out corrupt behavior. Former officers say the cases underscore a perennial challenge: guarding against scandal in a workforce -- the size of which is classified but is generally estimated to be 20,000 -- that prides itself on secrecy and deception. "You have an organization of professional liars," said Tyler Drumheller, who oversaw hundreds of officers as chief of the agency's European division. Experienced field managers are needed, he said, because inevitably "some people will try to take advantage of the system . . . and it's a system that can be taken advantage of." The recent string of embarrassing revelations started with the CIA's former No. 3 officer, Kyle "Dusty" Foggo, who was indicted on corruption charges two years ago.

Note: For in-depth analysis of the continuing revelations of a long history of the CIA's use of sex to control people, click here.

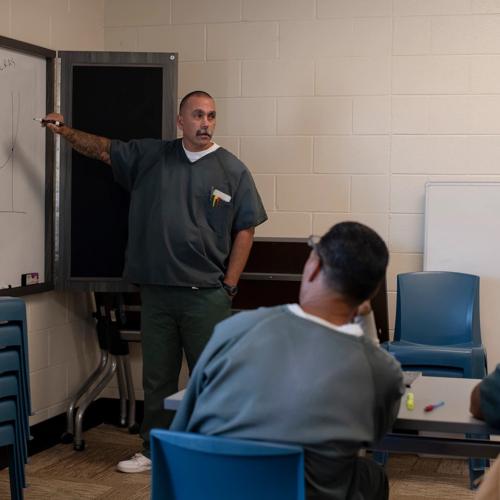

Why We Must Fix Our Prisons

March 29, 2009, Parade magazine

http://www.parade.com/news/2009/03/why-we-must-fix-our-prisons.html

America's criminal justice system has deteriorated to the point that it is a national disgrace. Its irregularities and inequities cut against the notion that we are a society founded on fundamental fairness. Our failure to address this problem has caused the nation's prisons to burst their seams with massive overcrowding, even as our neighborhoods have become more dangerous. We are wasting billions of dollars and diminishing millions of lives. We need to fix the system. Doing so will require a major nationwide recalculation of who goes to prison and for how long and of how we address the long-term consequences of incarceration. The United States has by far the world's highest incarceration rate. With 5% of the world's population, our country now houses nearly 25% of the world's reported prisoners. We currently incarcerate 756 inmates per 100,000 residents, a rate nearly five times the average worldwide of 158 for every 100,000. All told, about one in every 31 adults in the United States is in prison, in jail, or on supervised release. This all comes at a very high price to taxpayers: Local, state, and federal spending on corrections adds up to about $68 billion a year. Our overcrowded, ill-managed prison systems are places of violence, physical abuse, and hate, making them breeding grounds that perpetuate and magnify the same types of behavior we purport to fear. Post-incarceration re-entry programs are haphazard or, in some places, nonexistent, making it more difficult for former offenders who wish to overcome the stigma of having done prison time and become full, contributing members of society.

Note: The author of this analysis, Senator Jim Webb (D. Va.), is a PARADE Contributing Editor and the author of nine books, including A Time to Fight.

'US graft adds to Mexico's woes'

March 30, 2009, BBC News

http://news.bbc.co.uk/2/hi/americas/7971335.stm

Mexican President Felipe Calderon has warned that corruption among American officials may be making it harder to deal with drug-trafficking between Mexico and the US. Mr Calderon said violence in the border city of Juarez had fallen by 73% in the month since he sent 7,000 extra troops there. There has been open warfare in Juarez for more than a year; last year, 5,600 people were killed in drug-related attacks in Mexico, many in Juarez. President Calderon said it was impossible to smuggle [tons] of cocaine into the United States without the complicity of some American authorities. "There is trafficking in Mexico because there is corruption in Mexico," he told the BBC. "But by the same argument if there is trafficking in the United States it is because there is some corruption in the United States... It is impossible to pass tonnes of cocaine to the United States without the complicity of some American authorities." The situation along the border is very sensitive politically, and although the White House may wonder privately whether there is some corruption among some American customs, immigration and police officials, it is unlikely to admit it publicly.

Note: For powerfully revealing information on involvement of U.S. officials in the illegal drug trade, click here.

Communities print their own currency to keep cash flowing

April 5, 2009, USA Today

http://www.usatoday.com/money/economy/2009-04-05-scrip_N.htm

A small but growing number of cash-strapped communities are printing their own money. Borrowing from a Depression-era idea, they are aiming to help consumers make ends meet and support struggling local businesses. The systems generally work like this: Businesses and individuals form a network to print currency. Shoppers buy it at a discount – say, 95 cents for $1 value – and spend the full value at stores that accept the currency. Ed Collom, a University of Southern Maine sociologist who has studied local currencies, says they encourage people to buy locally. Merchants, hurting because customers have cut back on spending, benefit as consumers spend the local cash. "We wanted to make new options available," says Jackie Smith of South Bend, Ind., who is working to launch a local currency. "It reinforces the message that having more control of the economy in local hands can help you cushion yourself from the blows of the marketplace." About a dozen communities have local currencies, says Susan Witt, founder of BerkShares in the Berkshires region of western Massachusetts. She expects more to do it. Under the BerkShares system, a buyer goes to one of 12 banks and pays $95 for $100 worth of BerkShares, which can be spent in 370 local businesses. Since its start in 2006, the system, the largest of its kind in the country, has circulated $2.3 million worth of BerkShares. During the Depression, local governments, businesses and individuals issued currency, known as scrip, to keep commerce flowing when bank closings led to a cash shortage."

Special note: Kevin Ryan, who was fired from his job for investigating the 9/11 building collapses (click here for more), has just co-authored with Prof. Steven Jones and others a powerful paper on 9/11 in The Open Chemical Physics Journal. The article closes, "Based on these observations, we conclude that the red layer of the red/gray chips we have discovered in the WTC dust is active, unreacted thermitic material, incorporating nanotechnology, and is a highly energetic pyrotechnic or explosive material." To read this article online, click here.

Finding Balance: WantToKnow.info Inspiration Center

WantToKnow.info believes it is important to balance disturbing cover-up information with inspirational writings which call us to be all that we can be and to work together for positive change. For an abundance of uplifting material, please visit our Inspiration Center.

See our exceptional archive of revealing news articles.

www.momentoflove.org - Every person in the world has a heart

www.personalgrowthcourses.net - Dynamic online courses powerfully expand your horizons

www.WantToKnow.info - Reliable, verifiable information on major cover-ups

www.weboflove.org - Strengthening the Web of Love that interconnects us all

Subscribe here to the WantToKnow.info email list (two messages a week)