Related Stories

So When Will Banks Give Loans?

Key Excerpts from Article on Website of New York Times

Posted: October 31st, 2008

http://www.nytimes.com/2008/10/25/business/25nocera.html?par...

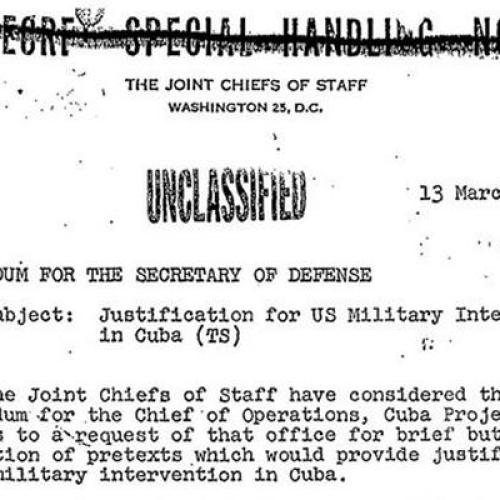

Chase recently received $25 billion in federal funding. What effect will that have on the business side and will it change our strategic lending policy? It was Oct. 17, just four days after JPMorgan Chases chief executive, Jamie Dimon, agreed to take a $25 billion capital injection courtesy of the United States government, when a JPMorgan employee asked that question [during] an employee-only conference call. The JPMorgan executive who was moderating the employee conference call didnt hesitate to answer. What we ... think it will help us do is perhaps be a little bit more active on the acquisition side or opportunistic side for some banks who are still struggling. I think there are going to be some great opportunities for us to grow in this environment, and I think we have an opportunity to use that $25 billion in that way. Read that answer as many times as you want you are not going to find a single word in there about making loans to help the American economy. On the contrary: It is starting to appear as if one of Treasurys key rationales for the recapitalization program namely, that it will cause banks to start lending again is a fig leaf, Treasurys version of the weapons of mass destruction. In fact, Treasury wants banks to acquire each other and is using its power to inject capital to force a new and wrenching round of bank consolidation. Treasury would even funnel some of the bailout money to help banks buy other banks. And, in an almost unnoticed move, it recently put in place a new tax break, worth billions to the banking industry, that has only one purpose: to encourage bank mergers. As a tax expert, Robert Willens, put it: It couldnt be clearer if they had taken out an ad.

Note: Was the real purpose of the "bailout" to strengthen the biggest banks by enabling them to gobble up the smaller ones at the public's expense? No wonder the legislation was rushed through without discussion! For lots more highly revealing reports on the Wall Street bailout, click here.

Related Stories

Latest News

Key News Articles from Years Past