Financial News Stories

Below are key excerpts of revealing news articles on financial corruption from reliable news media sources. If any link fails to function, a paywall blocks full access, or the article is no longer available, try these digital tools.

For further exploration, delve into our comprehensive Banking Corruption Information Center.

The pressure to repay debts is forcing poor nations to continue investing in fossil fuel projects to make their repayments on what are usually loans from richer nations and financial institutions, according to new analysis from the anti-debt campaigners Debt Justice and partners in affected countries. The group is calling for creditors to cancel all debts for countries facing crisis – and especially those linked to fossil fuel projects. “High debt levels are a major barrier to phasing out fossil fuels for many global south countries,” said Tess Woolfenden, a senior policy officer at Debt Justice. “Many countries are trapped exploiting fossil fuels to generate revenue to repay debt while, at the same time, fossil fuel projects often do not generate the revenues expected and can leave countries further indebted than when they started. This toxic trap must end.” According to the report, the debt owed by global south countries has increased by 150% since 2011 and 54 countries are in a debt crisis, having to spend five times more on repayments than on addressing the climate crisis. Sharda Ganga, the director of the Surinamese civil society group Projekta, said ... “The reality is that this is the new form of colonialism – we have exchanged one ruler for the rule of our creditors who basically already own what is ours. The difference is this time we signed the deal ourselves.”

Note: For more along these lines, see concise summaries of deeply revealing news articles on government corruption and income inequality from reliable major media sources.

Progressives are confused and distressed over the choice by many of our allies to devalue decentralization in the technology space, and even to portray it as worse than Big Tech alternatives. In recent months, a number of progressive commentators have attacked the very idea of decentralization, arguing that it’s a distraction from other political goals. This has also led to progressives making crypto a favorite target and, bizarrely, taking the positions of big banks, which are notoriously monopolistic. To us, the more pressing concern is legacy tech platforms—and their ongoing capture of user data. Decentralizing technology will prove crucial in ensuring that the world isn’t run by a handful of unelected technologists. Crypto is an exception to so much technology because it runs on blockchain and no single person or corporation can control it. We value a world where power is dispersed to the people, where no one is so powerful that they can dictate terms to the rest of us. A blockchain allows everyone to own their own data, to control their own information, and to port that information and data to another system at their discretion. It also allows for people to exchange both data and money in a peer-to-peer manner, without permission from expensive, bureaucratic, and—in many cases—unnecessary intermediaries. Migrants also use crypto to send money to their home countries, and this activity alone will become increasingly important as political and climate migration continues to accelerate.

Note: The US government financially attacked Wikileaks in 2010 after the organization published documentation of US military war crimes. This attack would have ended Wikileaks, but the organization instead embraced bitcoin and survived for several more years. For more along these lines, see concise summaries of deeply revealing news articles on financial system corruption from reliable major media sources.

The IMF and other neoliberal institutions in Ukraine are saying that there are quite a few jobs being created there. But the people I speak to can’t find jobs. On top of that, there are those 12 million people who are abroad. Where will there be jobs for them? There is a lot of talk about the Marshall Plan. But the main lessons from the Marshall Plan I did not see reflected in these recovery plans. First of all, there was the write-off of debts. Second of all, there were grants given to countries, and states were allowed to act as investors and were allowed to directly buy food for families or buy supplies for industries. This is not the case in Ukraine. In reality, a big part of the financial assistance given to Ukraine is in the form of debt. The help supposedly given by the IMF of $15 billion ... is actually $15 billion of debt. And because it’s debt, the interest rate on this debt will be something like 7 or 8 percent. The IMF, The World Bank, and the European Investment Bank have investments that total more than $20 billion of the Ukraine external debt. Countries like Germany, France, and Italy of the European Union are bilateral creditors. The European Commission has a plan of assistance to Ukraine. There are bilateral arrangements with the USA, Russia, and China. Although it is not exactly clear the amount due to China, it appears to be around $5 billion. There are private bondholders like BlackRock. BlackRock is the main investor in Ukrainian external bonds—sovereign bonds What the European Union is doing with Ukraine is what they did with Greece after 2010. The European Union made an agreement in 2010 with the IMF to gather money to give to the Greek government with very strong and brutal conditionalities. And that’s exactly what [is happening] with the type of assistance given to Ukraine. The debt trap for Ukraine is very dangerous. With the new financial assistance given to Ukraine, in the next ten years, the debt will increase by something like $40 billion. Essentially, from $132 to $170 billion. And the creditors know perfectly that it will be impossible for Ukraine to pay back all this debt.

Note: For more along these lines, see concise summaries of deeply revealing news articles on war and banking corruption from reliable major media sources.

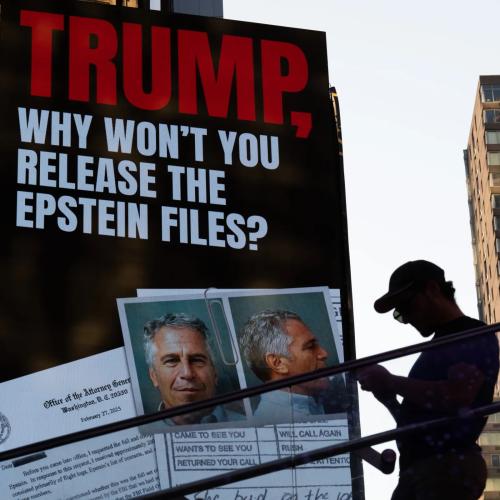

JPMorgan Chase reached a tentative settlement with sexual abuse victims of Jeffrey Epstein, the deceased financier, after weeks of embarrassing disclosures about the bank's longstanding relationship with him. David Boies, one of the lead lawyers for the victims, said the bank was prepared to pay $290 million to resolve the lawsuit. The proposed deal would settle a lawsuit filed ... on behalf of victims who were sexually abused by Mr. Epstein over a roughly 15-year period when they were teenage girls and young women. The number of victims could potentially rise to more than 100. JPMorgan still faces a related lawsuit by the government of the U.S. Virgin Islands. That suit remains the biggest outstanding Epstein-related case after years of lawsuits against Mr. Epstein's estate and Ghislaine Maxwell's conviction in 2021 in Manhattan federal court for helping Mr. Epstein engage in sex trafficking. The lawsuit filed by the victims claimed that JPMorgan ignored repeated warnings that Mr. Epstein had been trafficking teenage girls and young women for sex, even after he registered as a sex offender and pleaded guilty in a 2008 Florida case to soliciting prostitution from a teenage girl. The complaint said the bank had overlooked red flags in Mr. Epstein's activity because it valued him as a wealthy client who had access to dozens of even wealthier people. Legal documents revealed that after designating Mr. Epstein a "high risk client" in 2006, the bank kept him on as a customer.

Note: One Nation Under Blackmail is a new book by Whitney Webb, an investigative journalist who explores the deep ties between Jeffrey Epstein and US and Israeli Intelligence criminal networks. For more along these lines, see concise summaries of news articles on Jeffrey Epstein's child sex ring from reliable major media sources.

In 1998, Jeffrey Epstein purchased Little Saint James in the US Virgin Islands and began trafficking girls as young as 14 into "sexual servitude" at the secluded island. The same year, he opened his first account with JPMorgan Chase, the start of a lucrative partnership for the Wall Street giant that would continue for years after the late financier had been "red flagged" by the bank as a child sex offender. To keep his illicit sex-trafficking scheme running, Epstein needed access to large amounts of cash to pay off recruiters and attempt to silence victims. JPMorgan is alleged to have "pulled the levers" through which Epstein paid his network of enablers, according to a lawsuit filed by the US Virgin Islands (USVI) Attorney General in a US court. The lawsuit claims that JPMorgan concealed wire and cash transactions that were part of a "criminal enterprise" whose currency was vulnerable and desperate women and girls, groomed and recruited over decades by Epstein and his chief lieutenant Ghislaine Maxwell. In separate lawsuits, several survivors of Epstein's abuse sued JPMorgan and Deutsche Bank accusing them of actively enabling his abuse. The sprawling US Virgin Islands legal action is still pending. It has already drawn in some of the world's wealthiest individuals including billionaire JPMorgan CEO Jamie Dimon, Tesla CEO and Twitter owner Elon Musk, Google's co-founders Larry Page and Sergey Brin, and Microsoft co-founder Bill Gates. All have denied any involvement in Epstein's offending.

Note: One Nation Under Blackmail is a new book by Whitney Webb, an investigative journalist who explores the deep ties between Jeffrey Epstein and US and Israeli Intelligence criminal networks. For more along these lines, see concise summaries of news articles on Jeffrey Epstein's child sex ring from reliable major media sources.

JPMorgan Chase & Co. had ties to Jeffrey Epstein that ran deeper than the bank has acknowledged and extended years beyond when it decided to close the convicted sex offender’s accounts. Mary Erdoes, a top lieutenant to Chief Executive Jamie Dimon, made two trips to Epstein’s townhouse on Manhattan’s Upper East Side, in 2011 and 2013, when Epstein still was a client of the bank, said the people familiar with the matter. She exchanged dozens of emails with him and discussed sharing with him fees related to a charitable fund the bank was considering launching. John Duffy, who ran JPMorgan’s U.S. private bank for the ultrarich, went to Epstein’s townhouse for a meeting in April 2013, the people said. One month later, the private bank renewed an authorization allowing Epstein to borrow money against his accounts despite repeated warnings from compliance staffers about his unusual banking practices. Justin Nelson, one of Epstein’s bankers at JPMorgan, had about a half-dozen meetings at Epstein’s townhouse between 2014 and 2017. He also traveled to Epstein’s ranch in New Mexico in 2016. Epstein was convicted of soliciting a minor for prostitution in 2008 and forced to register as a sex offender. The new details show that JPMorgan was treating Epstein like a star client after his first conviction and despite repeated warnings from its own employees. And after JPMorgan closed Epstein’s accounts, bankers kept meeting with him for years.

Note: One Nation Under Blackmail is a new book by Whitney Webb, an investigative journalist who explores the deep ties between Jeffrey Epstein and US and Israeli Intelligence criminal networks. Epstein had many concerning associations, including with Noam Chomsky as reported in Webb's most recent article. For more along these lines, see concise summaries of deeply revealing news articles on banking corruption and Jeffrey Epstein's crime ring from reliable major media sources.

In recent months, the Pentagon has moved to provide loans, guarantees, and other financial instruments to technology companies it considers crucial to national security — a step beyond the grants and contracts it normally employs. So when Silicon Valley Bank threatened to fail in March following a bank run, the defense agency advocated for government intervention to insure the investments. The Pentagon had even scrambled to prepare multiple plans to get cash to affected companies if necessary, reporting by Defense One revealed. Their interest in Silicon Valley Bank stems from the Pentagon’s brand-new office, the Office of Strategic Capital. The secretary of defense established the OSC in December specifically to counteract the investment power of adversaries like China in U.S. technologies, and to secure separate funding for companies whose products are considered vital to national security. The national security argument for bailout, notably, found an influential friend in the Senate. As the Biden administration intervened to protect Silicon Valley Bank depositors on March 12, Sen. Mark Warner, D-Va., who chairs the powerful Senate Intelligence Committee and also sits on the Banking Committee, issued a press release warning that the bank run posed a national security risk. Warner — the only member of Congress to have publicly tied SVB to national security — has received significant contributions from the financial sector. Since 2012, Warner has received over $21,000 from Silicon Valley Bank’s super PAC.

Note: Many tech startups with funds in Silicon Valley Bank were working on projects with defense and national security applications. Explore revealing news articles on the rising concerns of the emerging technologies that the Defense Department is investing in, given their recent request for $17.8 billion to research and develop artificial intelligence, autonomy, directed energy weapons, cybersecurity, 5G technology, and more.

A US Virgin Islands investigations into the sex trafficker Jeffrey Epstein’s ties to an American bank issued subpoenas to four wealthy business leaders on Friday, extending its reach into the highest echelons of tech, hospitality and finance. The subpoenas issued to the Google co-founder Sergey Brin, Hyatt Hotels chairperson Thomas Pritzker, American-Canadian businessman Mortimer Zuckerman and former CAA talent agency chairperson Michael Ovitz are crafted to gather more information about Epstein’s relationship with JPMorgan Chase. The Virgin Islands’ lawsuit against JP Morgan, the world’s largest bank in terms of assets, alleges that the institution “facilitated and concealed wire and cash transactions that raised suspicion of – and were in fact part of – a criminal enterprise whose currency was the sexual servitude of dozens of women and girls in and beyond the Virgin Islands”. “Human trafficking was the principal business of the accounts Epstein maintained at JP Morgan,” it said. The disgraced financier ... owned two private islands – Little Saint James, or “Epstein Island”, and Great Saint James – in the American territory, and authorities there have secured a $105m settlement from his estate. The demand for any communications and documents related to the bank and Epstein from four of the wealthiest people in the US comes days after it was reported that Jamie Dimon, JP Morgan’s chairperson and chief executive, is expected to be deposed in the case.

Note: For more along these lines, see concise summaries of deeply revealing news articles on Jeffrey Epstein's child sex trafficking ring from reliable major media sources.

I participated in an online forum called US CBDC—A Disaster in the making? We had a very productive discussion about the policy aspect of central bank digital currencies (CBDCs). I believe that the Fed should not launch a CBDC. Ever. And I think that Congress should amend the Federal Reserve Act, just to be on the safe side. I want to distinguish between a wholesale CBDC and retail CBDC. With a wholesale CBDC, banks can electronically transact with each other using a liability of the central bank. That is essentially what banks do now. But retail CBDCs are another animal altogether. Retail CBDCs allow members of the general public to make electronic payments of all kinds with a liability of the central bank. This feature–making electronic transactions using a liability of the Federal Reserve–is central to why Congress should make sure that the Fed never issues a retail CBDC. The problem is that the federal government, not privately owned commercial banks, would be responsible for issuing deposits. And while this fact might seem like a feature instead of bug, it’s a major problem for anything that resembles a free society. The problem is that there is no limit to the level of control that the government could exert over people if money is purely electronic and provided directly by the government. A CBDC would give federal officials full control over the money going into–and coming out of–every person’s account. This level of government control is not compatible with economic or political freedom.

Note: The above was written by Norbert Michel, Vice President and Director of the Cato Institute's Center for Monetary and Financial Alternatives. For more along these lines, see concise summaries of deeply revealing news articles on financial system corruption from reliable major media sources.

Among the many surprising assets uncovered in the bankruptcy of the cryptocurrency exchange FTX is a relatively tiny one that could raise big concerns: a stake in one of the country’s smallest banks. The bank, Farmington State Bank in Washington State, has a single branch and, until this year, just three employees. It did not offer online banking or even a credit card. The tiny bank’s connection to the collapse of FTX is raising new questions about the exchange and its operations. The ties between FTX and Farmington State Bank began in March when Alameda Research, a small trading firm and sister to FTX, invested $11.5 million in the bank’s parent company, FBH. At the time, Farmington was the nation’s 26th-smallest bank out of 4,800. Its net worth was $5.7 million. FTX is a now bankrupt company that was one of the world’s largest cryptocurrency exchanges. A judge allowed the law firm Sullivan & Cromwell to continue advising FTX on bankruptcy. It’s unclear how FTX was allowed to buy a stake in a U.S.-licensed bank, which would need to be approved by federal regulators. Banking veterans say it’s hard to believe that regulators would have knowingly allowed FTX to gain control of a U.S. bank. “The fact that an offshore hedge fund that was basically a crypto firm was buying a stake in a tiny bank for multiples of its stated book value should have raised massive red flags for the F.D.I.C., state regulators and the Federal Reserve,” said Camden Fine, a bank industry consultant.

Note: An in-depth investigation by Whitney Webb and Ed Berger further unearths the mysterious connections between FTX and Farmington State Bank. Extending far beyond Sam Bankman-Fried and FTX, they make a case for a deeper criminal network at play, with troubling connections to this bank. Incidentally, the firm Sullivan & Cromwell has old connections with the CIA. For more along these lines, see concise summaries of deeply revealing news articles on financial industry corruption from reliable major media sources.

A pair of attorneys defending FTX founder Sam Bankman-Fried against one of the biggest white-collar prosecutions in decades are veterans of high-profile cases, including ones involving drug lord “El Chapo” and disgraced socialite Ghislaine Maxwell. Mark Cohen and Christian Everdell, former federal prosecutors who are now partners in the New York-based boutique firm Cohen & Gresser ... are up against hard-charging Justice Department lawyers who moved quickly to indict Mr. Bankman-Fried after FTX’s collapse and secured two of his former top lieutenants as cooperating witnesses. The Manhattan U.S. attorney’s office this past month charged Mr. Bankman-Fried with stealing billions of dollars from FTX customers while misleading investors and lenders connected to his crypto-trading firm Alameda Research. He faces charges of fraud, conspiracy, money laundering and campaign-finance violations and pleaded not guilty last week. Messrs. Cohen, 59 years old, and Everdell, 48, have already navigated their client through a thorny extradition from the Bahamas, where Mr. Bankman-Fried had been jailed after the Justice Department requested that local police arrest him. The two lawyers worked with local counsel to secure his transfer to U.S. custody while negotiating with federal prosecutors his pretrial release under a $250 million bond. They are now tasked with combing through voluminous and technical discovery, including documents relating to FTX investors, debtors and political campaigns.

Note: For more along these lines, see concise summaries of deeply revealing news articles on financial industry corruption from reliable major media sources.

The former attorney general for the Virgin Islands, who recently secured a $105 million settlement from the estate of Jeffrey Epstein, was recently fired following months of friction between her and the U.S. territory’s governor over the handling of the investigation into the disgraced financier, according to people briefed on the matter. Denise N. George, the former official, was dismissed by Albert Bryan Jr., the governor of the Virgin Islands, on New Year’s Eve, four days after her office sued JPMorgan Chase in federal court in Manhattan for its dealings with Mr. Epstein, who died of an apparent suicide in 2019 while in federal custody. The timing of Ms. George’s firing fueled media speculation in the Virgin Islands and beyond that the suit against JPMorgan was the immediate cause. In late December, Ms. George’s office sued JPMorgan in federal court in Manhattan, claiming that bank was derelict in providing banking services to Mr. Epstein during the time he was charged with sexually abusing teenage girls and young women at Little St. James and elsewhere in the U.S. The lawsuit accused JPMorgan of facilitating and concealing wire and cash transactions that should have raised suspicions that Mr. Epstein was engaging in the sexual trafficking of teen girls and young women. The lawsuit contends the bank essentially turned a “blind eye” to Mr. Epstein’s conduct because it was profitable. JPMorgan, the largest U.S. bank by assets, was Mr. Epstein’s primary banker from the late 1990s to 2013.

Note: For more along these lines, see concise summaries of deeply revealing news articles on banking corruption and Jeffrey Epstein's sex trafficking ring from reliable major media sources.

The government of the U.S. Virgin Islands alleges in a lawsuit filed this week that JPMorgan Chase "turned a blind eye" to evidence that disgraced financier Jeffrey Epstein used the bank to facilitate sex-trafficking activities on Little St. James, the private island he owned in the territory until his 2019 suicide. In a more than 100-page complaint filed by U.S.V.I. Attorney General Denise George in the Southern District of New York in Manhattan on Tuesday, the territory alleges that JPMorgan failed to report Epstein's suspicious activities and provided the financier with services reserved for high-wealth clients after his 2008 conviction for soliciting a minor for prostitution in Palm Beach, Fla. The complaint says the territory's Department of Justice investigation "revealed that JP Morgan knowingly, negligently, and unlawfully provided and pulled the levers through which recruiters and victims were paid and was indispensable to the operation and concealment of the Epstein trafficking enterprise." It accused the bank of ignoring evidence for "more than a decade because of Epstein's own financial footprint, and because of the deals and clients that Epstein brought and promised to bring to the bank." "These decisions were advocated and approved at the senior levels of JP Morgan," it said. The bank allegedly "facilitated and concealed wire and cash transactions that raised suspicion of — and were in fact part of — a criminal enterprise whose currency was the sexual servitude of dozens of women and girls," according to the complaint.

Note: Just days after filing the lawsuit against JP Morgan Chase, the district attorney of US Virgin Islands was fired. For more along these lines, see concise summaries of deeply revealing news articles on Jeffrey Epstein's sex trafficking ring from reliable major media sources.

Federal regulators fined Wells Fargo a record $1.7 billion on Tuesday for “widespread mismanagement” over multiple years that harmed over 16 million consumer accounts. Wells Fargo’s “illegal activity” included repeatedly misapplying loan payments, wrongfully foreclosing on homes, illegally repossessing vehicles, incorrectly assessing fees and interest and charging surprise overdraft fees. The CFPB ordered Wells Fargo to pay the $1.7 billion civil penalty in addition to more than $2 billion to compensate consumers for a range of “illegal activity.” CFPB officials say this is the largest penalty imposed by the agency. The misconduct described by the CFPB echoes previously reported revelations that have emerged about Wells Fargo since 2016 when the bank’s fake-accounts scandal created a national firestorm. “Wells Fargo’s rinse-repeat cycle of violating the law has harmed millions of American families,” Rohit Chopra, the CFPB’s director, said in a statement. Chopra noted that the settlement does not provide immunity for individuals at Wells Fargo, and the agency recognizes the $3.7 billion in fines and restitution will not fix the bank’s problems. Although Chopra credited Wells Fargo with making some progress, he said it’s not clear “they are making rapid enough progress” and said the agency is concerned that the bank’s product launches, growth initiatives and profit-boosting efforts have “delayed needed reform.”

Note: In 2016, Wells Fargo was caught opening millions of fake accounts in its customers' names. For more along these lines, see concise summaries of deeply revealing news articles on financial system corruption from reliable major media sources.

Many of the world’s largest asset managers and state pension funds are passively investing in companies that have allegedly engaged in the repression of Uyghur Muslims in China, according to a new report. The report, by UK-based group Hong Kong Watch and the Helena Kennedy Centre for International Justice at Sheffield Hallam University, found that three major stock indexes provided by MSCI include at least 13 companies that have allegedly used forced labour or been involved in the construction of the surveillance state in China’s Xinjiang region. In recent years, China has come under increased scrutiny over what the UN has called “serious human rights violations” against Uyghur Muslims in the region, including systemic discrimination, mass arbitrary detention, torture, and sexual and gender-based violence. The report includes a list of major asset managers, including BlackRock, HSBC and Deutsche Bank among others, exposed to index funds that include companies accused of engaging in labour transfers and the construction of repressive infrastructure in the region. It found public pension funds across the UK, Canada and the US and funds in New Zealand and Japan exposed by the investments. “So many people’s pensions, retirement funds and savings are invested passively because, as average consumers, we don’t have time to investigate each and every investment,” said Laura Murphy, one of the report’s authors and professor of human rights and contemporary slavery at Sheffield Hallam University.

Note: Read an eye-opening article about the shocking human rights violations happening to the Uyghur people under the auspices of the Chinese government. For more along these lines, see concise summaries of deeply revealing news articles on financial system corruption from reliable major media sources.

A former Vatican financial auditor has filed suit against the Vatican Secretariat of State, demanding the Catholic Church pay for damage to his reputation that he alleges followed his unceremonious firing in 2017. Libero Milone was hired in 2015 by Pope Francis to look into the notoriously convoluted and troubled finances of Vatican departments, as part of continuing financial reforms begun by Pope Benedict XVI. Only two years later, the Vatican announced that Milone had resigned in the face of accusations of embezzlement and of spying. Cardinal Angelo Becciu told reporters that the auditor “went against all rules and was spying on the private lives of his superiors and staff, myself included.” Milone called the cardinal “a liar.” Now, Milone says, he is ready to share proof of the financial mismanagement he said he witnessed at Vatican-owned hospitals and in the church bureaucracy. Milone framed his firing as a battle between “the Middle Ages and modernity” and called out “the small mafia at the Vatican” that was offended by his findings of lapses in the Catholic institution’s finances, including “many cases of rule violations, improper predisposition of accounting records, incorrect registrations.” He said he has proof that several other Vatican offices concealed transactions or obstructed auditors’ attempts to see real estate and investment portfolios. He also pointed to significant anomalies in the management of funds at the troubled Catholic pediatric hospital Bambino Gesù.

Note: In 2012, leaked documents revealed that the Vatican Bank was used for money laundering. For more along these lines, see concise summaries of deeply revealing news articles on financial corruption from reliable major media sources.

The Federal Reserve, far from the independent institution it often touts itself as, is under intense pressure at all times from massive commercial banks and other financial institutions advocating for favorable regulations, according to federal lobbying disclosures reviewed by The Intercept, as well as interviews with former Fed and other finance employees. The Federal Reserve has come under scrutiny in recent months for its aggressive interest rate hikes. The Fed’s own research has warned that its aggressive policy mirrors a similar one that caused a “severe recession” under Paul Volcker in the 1980s. Even the United Nations ... recently warned that the Fed’s rate hikes risk “inflicting worse damage than the financial crisis in 2008 and the COVID-19 shock in 2020.” Besides setting monetary policy, the Fed is also tasked with regulating commercial banks. The intense lobbying the Fed is subjected to is targeted at these banking regulations. Paid lobbyists make their case on behalf of massive financial corporations in the same fashion as K Street lobbyists hawking their wares to members of Congress. In 2022 alone, over 120 groups reported lobbying the Fed on issues ranging from credit card fees to cryptocurrency to sprawling monetary policy initiatives such as mortgage finance. Postings on the Federal Reserve website in the past year record meetings with Discover Financial, Student Loan Servicing Alliance, National Bankers Association, Capital One, JPMorgan Chase, Morgan Stanley, and Goldman Sachs.

Note: For more along these lines, see concise summaries of deeply revealing news articles on financial system corruption from reliable major media sources.

Thousands of officials across the government’s executive branch reported owning or trading stocks that stood to rise or fall with decisions their agencies made, a Wall Street Journal investigation has found. More than 2,600 officials at agencies from the Commerce Department to the Treasury Department, during both Republican and Democratic administrations, disclosed stock investments in companies while those same companies were lobbying their agencies for favorable policies. That amounts to more than one in five senior federal employees across 50 federal agencies reviewed by the Journal. A top official at the Environmental Protection Agency reported purchases of oil and gas stocks. The Food and Drug Administration improperly let an official own dozens of food and drug stocks on its no-buy list. A Defense Department official bought stock in a defense company five times before it won new business from the Pentagon. The Journal obtained and analyzed more than 31,000 financial-disclosure forms for about 12,000 senior career employees, political staff and presidential appointees. The review spans 2016 through 2021 and includes data on about 850,000 financial assets and more than 315,000 trades. More than five dozen officials at five agencies, including the Federal Trade Commission and the Justice Department, reported trading stock in companies shortly before their departments announced enforcement actions, such as charges and settlements, against those companies.

Note: You can read the entire article free of charge on this webpage. For more along these lines, see concise summaries of deeply revealing news articles on government corruption from reliable major media sources.

Russia's war on Ukraine has wreaked havoc on global commodity markets, driving up energy and food prices and exacerbating hunger emergencies around the world. But while disastrous for the global poor ... the chaos has been a major boon for Wall Street giants. "The 100 biggest banks by revenue are set to make $18 billion from commodities trading in 2022," Bloomberg reported Friday. "The prediction is the latest evidence that the wild swings in energy prices triggered by the war in Ukraine are delivering a boon to commodity traders, even as they push European nations into crisis," Bloomberg added. "Vali, an analytics firm that tracks trading business, compiled data that includes the leading five banks in commodity trading: Macquarie Group Ltd., Goldman Sachs Group Inc., JPMorgan Chase & Co., Citigroup Inc., and Morgan Stanley." "People's misery makes capitalists' superprofit," Salvatore De Rosa, a researcher at the Lund University Center for Sustainability Studies. The World Food Program estimates that "as many as 828 million people go to bed hungry every night" and ... "those facing acute food insecurity has soared—from 135 million to 345 million—since 2019." "It's too easy to say the war in Ukraine has unbalanced all these markets, [or that] supply chains and the ports are shot, and that there's a supply and demand reason for these prices going up," [Michael] Greenberger added. "My own best guess is anywhere from 10% to 25% of the price, at least, is dictated by deregulated speculative activity."

Note: For more along these lines, see concise news summaries revealing banking corruption from reliable major media sources. You can also visit our Banking Information Center to further explore corruption in the financial industry.

Tech billionaires are buying up luxurious bunkers and hiring military security to survive a societal collapse they helped create, but like everything they do, it has unintended consequences. Their extreme wealth and privilege ... make them obsessed with insulating themselves from the very real and present danger of climate change, rising sea levels, mass migrations, global pandemics, nativist panic and resource depletion. For them, the future of technology is about only one thing: escape from the rest of us. What, if anything, could we do to resist it? A former president of the American chamber of commerce in Latvia ... JC Cole had witnessed the fall of the Soviet empire, as well as what it took to rebuild a working society almost from scratch. He believed the best way to cope with the impending disaster was to change the way we treat one another, the economy, and the planet right now. JC’s real passion wasn’t just to build a few isolated, militarised retreat facilities for millionaires, but to prototype locally owned sustainable farms that can be modelled by others and ultimately help restore regional food security in America. Investors not only get a maximum security compound in which to ride out the coming plague, solar storm, or electric grid collapse. They also get a stake in a potentially profitable network of local farm franchises that could reduce the probability of a catastrophic event. His business would do its best to ensure there are as few hungry children at the gate as possible when the time comes to lock down.

Note: Read about a Cold War U.S. government missile silo that was transformed into a luxury bunker to prepare for the apocalypse in this previously reported news article. You might also consider exploring revealing news articles on food system corruption impacting our economy and environment.

Important Note: Explore our full index to revealing excerpts of key major media news stories on several dozen engaging topics. And don't miss amazing excerpts from 20 of the most revealing news articles ever published.