Inspiring: Reimagining the Economy Media Articles

Below are key excerpts of inspiring news articles on reimagining the economy from reliable news media sources. If any link fails to function, a paywall blocks full access, or the article is no longer available, try these digital tools.

For further exploration, delve into our Inspiration Center.

Traditional dairy farms calves are separated from their mothers within 24 hours of their birth. It allows farmers to collect the milk that the calves would naturally drink and sell it to be made into dairy products. But one farmer in the south of Scotland is pioneering an unconventional method of commercial dairy farming - keeping cow and calf together for about six months. David Finlay, who farms 130 dairy cows near Gatehouse of Fleet, claims the system results in higher animal welfare standards and a more profitable business. Now he is calling for the Scottish government to fund a radical new cow-with-calf development programme. The Finlays implemented the cow-with-calf system with their herd, but the decision almost bankrupted the business when they did not have enough milk left to sell to market. After overhauling their business plan and adopting a new approach, the couple found a way of making the system financially viable. David claims that among the benefits are happier cows and staff, healthier animals and an increase in life-expectancy. "What we've found is we can carry 25% more cows on the farm, because the young stock are growing and maturing so much faster and the cows are yielding 25% more milk," he said. "So even with the calves drinking a third of their mother's milk, the system is actually more efficient, more productive and more profitable." Rainton Farm is now the largest commercial cow-with-calf dairy farm in Europe.

Note: Explore more positive stories like this on reimagining the economy and healing the Earth.

This week, the nonprofit Veterans Community Project (VCP) broke ground on its sixth tiny home village, this time in Milwaukee, Wisconsin, to offer more military veterans a fresh start with housing and individualized care. Each 240-square-foot home is part of a larger community designed to help residents regain stability and independence. Since its founding in 2018 when they welcomed their first residents in Kansas City, VCP has helped hundreds of vets transition out of homelessness. VCP has set a new standard for how cities can address veteran homelessness, with its 85% success rate for vets who complete the program successfully and transition to sustainable permanent housing—all in an average of 335 days. Army combat veteran Dave Myers ... had never heard of VCP when his life was spinning out of control three years ago, addicted to drugs after returning home from war. He now smiles recalling a judge’s words ordering him to become a volunteer after he got clean in prison: “He told me, ‘You’re going to spend so much time with these guys that they’re either going to love you or hate you ... I hope it’s the former, and that they offer you a job after.’” Dave is now a full-time operations employee at VCP and is fulfilling his dream to help Veterans. “I was able to connect with our residents in some ways that not a lot of other people can. I’ve been in their shoes.” “This place saved me,” he said proudly.

Note: Explore more positive stories like this on healing the war machine and reimagining the economy.

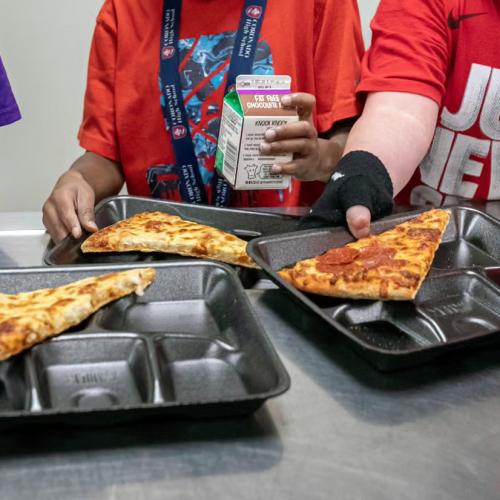

California has long led the way on school meals. In 2022, it became the first state in the country to make school meals free for all students, regardless of income. Many districts have implemented farm-to-school programs to bring local foods into the cafeteria. And last year, months before the “Make America healthy again” movement would make its way to the White House, it became the first state in the nation to ban six synthetic food dyes from school meals. This week, it passed legislation that will put it in the lead on school meals in yet another way – banning ultra-processed foods. On Friday, California lawmakers passed a bill that will define, and then ban, ultra-processed foods from school meals. Ultra-processed foods, or UPFs, are industrially formulated products that are often high in fats, starches, sugars and additives, and make up 73% of the US food supply today. The text of California’s new law defines a UPF as any food or beverage that contains stabilizers, thickeners, propellants, colors, emulsifiers, flavoring agents, flavor enhancers, nonnutritive sweeteners or surface-active agents – and has high amounts of saturated fat, sodium or added sugar, or nonnutritive sweeteners. “We actually had food service directors come in and testify,” [state assembly member Jesse Gabriel] said. “Not only had it not cost them more, but in many districts they had actually saved money by switching to healthier alternatives.”

Note: Explore more positive stories like this on healing our bodies and reimagining the economy.

As I approach India's first Garbage Cafe on a cloudy and foggy winter day in early 2025, the smell of hot samosas immediately makes the place feel cosy. Inside, people are sitting on wooden benches holding steel plates filled with steaming meals, some chatting, others eating quietly. Every day, hungry people arrive at this cafe in Ambikapur, a city in the state of Chhattisgarh in central India, in the hope of getting a hot meal. But they don't pay for their food with money – instead, they hand over bundles of plastic such as old carrier bags, food wrappers and water bottles. People can trade a kilogram (2.2lb) of plastic waste for a full meal that includes rice, two vegetable curries, dal, roti, salad and pickles, says Vinod Kumar Patel, who runs the cafe on behalf of the Ambikapur Municipal Corporation (AMC), the public body which manages the city's infrastructure. Every morning, [Rashmi Mondal] sets out early on the streets of Ambikapur in a search for discarded plastic – anything from old food wrappers to plastic bottles. For her, collecting such detritus is a means of survival. "I've been doing this work for years," Mondal says, looking at the small pile of plastic she has gathered. Previously, Mondal used to sell the plastic she collected to local scrap dealers for just 10 Indian rupees (£0.09/$0.12) per kilogram – barely enough to survive on. "But now, I can get food for my family in exchange for the plastic I collect. It makes all the difference in our lives."

Note: Explore more positive stories like this on reimagining the economy.

No toilets, expensive food of dubious quality, crowded housing. This was the reality for many in 1840s Britain. Something had to change. And the Rochdale Pioneers knew it. The group of 28 artisans and cotton weavers ... wanted to start a co-operative society in order to provide their community with affordable and unadulterated food. Their small grocery shop started by selling only flour, sugar, oatmeal and butter and opened just before Christmas 1844. Any profit was shared among member-owners. With this, the co-operative movement took root. Today, these businesses employ some 280 million people around the world – 10% of the employed population. Approximately 3m co-ops with an astonishing 1.2bn members, more than an eighth of the world’s population, exist internationally. Shared Interest is a UK-based social lender that supports farmers and handcraft producers in 47 countries around the world. From sphagnum moss farmers in Peru to coffee farmers in Rwanda, the organisation provides finance for smallholder communities that collectively provide around a third of the world’s food but are often stuck in cycles of poverty. Uganda-based coffee producer Bukonzo Organic Farmers Cooperative Union (BOCU), which Shared Interest has supported since 2014 ... negotiates prices, undertakes marketing and manages export on behalf of 13 smaller primary co-ops. Having this tiered system is crucial for small-scale farmers who don’t speak English.

Note: Explore more positive stories like this on reimagining the economy.

Rajabai Sawant used to pick and sort waste on the streets of Pune with a sack on her back. The plastic she collected from a public waste site would be sold for some money that saved her children from begging. Today, dressed in a dark green jacket monogrammed with the acronym Swach (solid waste collection and handling) over a colourful sari, the 53-year-old is one among an organised group of waste collectors and climate educators who teach residents in urban Pune how to segregate and manage waste, based on a PPPP – a pro-poor private public partnership. Swach was set up in 2005 by a trade union of waste pickers, Kagad Kach Patra Kashtakari Panchayat (KKPKP), which was ... envisioned a scheme that enhanced waste collectors’ work instead of displacing them. These [PPPP] partnerships are contracts between the state or local authority and a group of private individuals that aim to provide a public service while simultaneously alleviating poverty. Of the waste generated by the city, Swach sorts and recycles about 227 tonnes a day (82,891 tonnes a year) that is diverted away from landfills. It saves the city £10m that would have been needed for processing, transportation and human resources. Today, Swach has more than 3,850 self-reliant waste picker members, who provide daily doorstep waste collection services to citizens of Pune who pay a small monthly fee. Under the PPPP, each member is a shareholder and earns about 16,000 rupees (£140) a month.

Note: Explore more positive stories on reimagining the economy.

Parents with small children, teenagers, and senior citizens clustered outside the door and waited to hear their ticket numbers called. They weren’t there for books. They came to shop for groceries. Connected to the [Enoch Pratt Library], the brightly painted market space is small but doesn’t feel cramped. Massive windows drench it in sunshine. In a previous life, it was a café. Now, shelves, tables, counters, and a refrigerator are spread out across the room, holding a mix of produce and shelf-stable goods. On any given day, there’s a range of produce, like collard greens, apples, onions, radishes, potatoes, and cherry tomatoes, plus eggs, orange juice, rice, bread, and treats like cookies and peanut butter crackers. As they exited, shoppers did not need to pull out their wallets: No one pays at Pratt Free Market. Launched in the fall of 2024, Pratt Free Market opens its doors every Wednesday and Friday and serves around 200 people per day. Anyone can pick up food at the store without providing identification or meeting income requirements. For Baltimore residents, 28 percent reported experiencing food insecurity last year—twice the national average. Pratt Free Market ... offers a mix of everything—from healthy, fresh produce to sweets. And every fourth Friday, the marker turns into “Pantry on the Go!”, a farmers’ market-style setup outside the library that offers fruits and vegetables. Last month ... they handed out onions, sweet potatoes, watermelons, celery, and apples.

Note: Explore more positive stories like this on reimagining the economy.

Community currencies — alternative forms of money sometimes also referred to as local or regional currencies — are as diverse as the communities they serve, from grassroots time-banking and mutual credit schemes to blockchain-based Community Inclusion Currencies. Local currencies were common until the 19th century, when the newly emerging nation states transitioned to a centralized system of government-issued money as a way of consolidating their power and stabilizing the economy. Far from being a neutral system of exchange, a currency is a tool to achieve certain goals. Inequality and unsustainability are baked into our monetary system, which is based on debt and interest with practically all the money ... being created by private banks when issuing loans. Well-designed community currencies eliminate two main sources of financial inequality: money’s perceived inherent value and the interest rates, which both incentivize people to hoard their money. Like the pipes that bring water to your house, money is the conduit that gives you access to goods and services. The value of money is created in the transaction. In 2015 it was estimated that almost 400 of them are active in Spain alone, and across Africa blockchain-backed systems, like the Sarafu in Kenya, help underserved communities do business without conventional money. Elsewhere, local currencies like the Brixton pound in the U.K. or BerkShares in Massachusetts are a way to keep money in the community, buffering it against the pressures of a globalized economy.

Note: Explore more positive stories like this on reimagining the economy.

It’s 4pm on a Friday, and the staff at Home Kitchen, north London’s buzziest new restaurant, are prepping for another busy evening’s service. Not only is the restaurant run not-for-profit, but nearly all of the staff members have experienced homelessness: a first of its kind in the fine-dining industry. The project is run by a five-strong team, which includes two-time Michelin-starred chef Adam Simmonds and Soup Kitchen London director Alex Brown. Home Kitchen partnered with homelessness charity Crisis and social enterprise Beam to fill eight kitchen and eight front of house roles, when they opened their restaurant in autumn 2024. Other partners include the Beyond Food Foundation, the Only A Pavement Away charity and fellow charity, The Passage. Funded by a £500,000 crowdfunding drive and social investment loans, Home Kitchen provides staff with a comprehensive package that’s designed to help them avoid returning to homelessness. The 16 staffers are employed on full-time contracts, paid at London Living Wage, have their travel cards covered for zones one and two, and receive catering qualifications in addition to in-house training. The employee support offered by Crisis and Beam is ongoing, while the Home Kitchen team leaders take it upon themselves to check in with staff every day. “[There’s] a lot of support, a lot mentally. If someone’s upset, straight away they’ll take them to a corner and be like: ‘Talk to me, what’s happening?’ It’s really, really, really nice,” [French-Algerian chef] Mimi says. At the end of daily service, the team sit down and break bread (literally) with a communal meal. “It’s a brilliant team. Everybody supports everybody,” adds Jones, with a smile. “When service starts, we’re all equal.”

Note: Explore more positive stories like this on reimagining the economy.

In 2015, [Jo] Nemeth had quit her community development job, given the last of her money to her 18-year-old daughter Amy and closed her bank account. “I was 46, I had a good job and a partner I loved, but I was deeply unhappy,” Nemeth says. “I’d been feeling this growing despair about the economic system we live in.” Her “lightbulb moment” came when her parents ... gave her a book about people with alternative lifestyles. “When I read about this guy choosing to live without money, I thought, ‘Oh my God, I have to do that!’” The first thing Nemeth did was write a list of her needs. "I discovered I really didn’t need much to be comfortable. Then I just started ... figuring out how I could meet my needs without having any negative impacts.” For the first three years, Nemeth lived on a friend’s farm, where she built a small shack from discarded building materials before doing some housesitting and living off-grid for a year in a “little blue wagon” in another friend’s back yard. Instead of paying rent, Nemeth cooks, cleans, manages the veggie garden and makes items such as soap, washing powder and fermented foods. And she couldn’t be happier. She soon started tapping into the “gift economy” more deeply, giving without expecting anything in return, receiving without any sense of obligation. “That second part took a while to get used to,” she says. “It’s very different to bartering or trading, which involves thinking in a monetary, transactional way: I’ll give you this if you give me that. I actually feel more secure than I did when I was earning money,” she says, “because all through human history, true security has always come from living in community and I have time now to build that ‘social currency’. To help people out, care for sick friends or their children, help in their gardens. That’s one of the big benefits of living without money.”

Note: Explore more positive stories like this on reimagining the economy.

When 94-year-old Bob Moore died in February, Bob's Red Mill not only lost its founder but also the face of the company, literally — he's on every package. But in 2010, the natural foods company initiated a process that would help prepare it for Moore's eventual passing. Moore, who founded the whole-grain food company in 1978 and turned it into a global empire, decided to transfer ownership to its more than 700 employees. By 2020, Bob's Red Mill was entirely employee-owned. "By becoming 100% employee-owned, we knew that when Bob passed that we would control our future," Trey Winthrop, the company's CEO since 2022, [said]. Moore said he frequently fended off large corporations that wanted to buy them out. But because of the employee-ownership program, Winthrop, who has worked at Bob's Red Mill for 19 years, said he did not have to worry about an external threat coming in and trying to buy up shares. Bob's Red Mill is one of about 6,500 American companies that operate with an Employee Stock Ownership Plan, or ESOP. The largest majority employee-owned company in the US as of November is Publix, a Florida-based supermarket chain. Winthrop ... said being employee-owned boosts employee engagement and retention. He said it creates a two-way street of communication, where the company can share financials with employees and workers are given a voice, in part through being active in committees.

Note: Explore more positive stories like this in on reimagining the economy.

In January 2024, The GivingBlock, one of the largest crypto donation platforms, reported that crypto donations had reached more than $2 billion, projected to exceed $10 billion by 2032. Crypto donors, who are largely millennials, contribute on average 128 times more per donation than cash donors. By leveraging tax incentives like capital gain offsets to eliminate taxes on donations, crypto giving is as financially smart as it is impactful. But the benefits of crypto giving go far beyond the financial incentives. Social impact is embedded in the foundation of Web 3. This new economy is fueled by cutting out traditional middlemen, banks, and allowing transparent, secure, and borderless peer-to-peer payments. No ID or passport is needed. This allows people, especially the unbanked, to have full control of their assets with minimal fees. Ethereum co-founder Vitalik Buterin has championed using memecoin momentum for good, saying, “I want to see quality fun projects that positively impact the ecosystem and the world.” He donated nearly $2 million in memecoin winnings to charities, including $532,000 to the Effective Altruism Fund's Animal Welfare Fund and over $1 million to the United Humanitarian Front, an organization providing grants to humanitarian relief initiatives in Ukraine. New Story, a nonprofit building homes to alleviate homelessness worldwide, partnered with artist Brian Ku to release a limited edition series of NFTs where each sale provided a 3D house for a family in Latin America.

Note: Watch our latest video on the potential for blockchain to fix government waste and restore financial freedom. Explore more positive stories like this on technology for good.

The fusion of artificial intelligence (AI) and blockchain technology has generated excitement, but both fields face fundamental limitations that can’t be ignored. What if these two technologies, each revolutionary in its own right, could solve each other’s greatest weaknesses? Imagine a future where blockchain networks are seamlessly efficient and scalable, thanks to AI’s problem-solving prowess, and where AI applications operate with full transparency and accountability by leveraging blockchain’s immutable record-keeping. This vision is taking shape today through a new wave of decentralized AI projects. Leading the charge, platforms like SingularityNET, Ocean Protocol, and Fetch.ai are showing how a convergence of AI and blockchain could not only solve each other’s biggest challenges but also redefine transparency, user control, and trust in the digital age. While AI’s potential is revolutionary, its centralized nature and opacity create significant concerns. Blockchain’s decentralized, immutable structure can address these issues, offering a pathway for AI to become more ethical, transparent, and accountable. Today, AI models rely on vast amounts of data, often gathered without full user consent. Blockchain introduces a decentralized model, allowing users to retain control over their data while securely sharing it with AI applications. This setup empowers individuals to manage their data’s use and fosters a safer, more ethical digital environment.

Note: Watch our 13 minute video on the promise of blockchain technology. Explore more positive stories like this on reimagining the economy and technology for good.

The arrest of Telegram’s founder and the takedown of Simply Bitcoin’s Youtube channel for violating Youtube’s “harmful and dangerous” policy ... speaks to the power of corporations to mediate the reach of speech. French authorities have claimed that Durov was arrested, for among other things, providing “cryptology” tools. States couch their control of virtual space as an extension of their physical authority. Platforms and individuals are held to account for “crimes” being perpetuated on virtual space. One common thread is ... the idea of “misinformation.” Another is to use the most heinous crimes in a witch hunt - child abuse sexual material for example. Another favorite is “terrorism.” Networks like Bitcoin and Nostr are more needed than ever. They both give people geographic arbitrage, the ability to operate without corporate leadership, and a hedge against state repression. The network cannot be shut down or threatened to change its rules as quickly and as easily as arresting one CEO. Is the idea of “decentralization” possible in a world where states can arrest CEOs and founders? Nothing can prevent somebody from exchanging funds with one another using Bitcoin or expressing something on Nostr. Usage of these networks in a peer-to-peer manner with an array of self-custody wallets and clients shows a popular demand for privacy, encryption, and transmitting value without the prying eyes of the state.

Note: Watch our latest video on the potential for blockchain to fix government waste and restore financial freedom. Explore more positive stories like this on technology for good.

Since religious riots tore across the central Nigerian city of Jos two decades ago, its Muslim and Christian residents have largely kept apart. They have their own neighborhoods. They vote for different political parties. But the cost-of-living crisis that has swept Nigeria over the past year has blurred some of those boundaries. “If there is hunger in the land, the hunger that the Christian is feeling is not different from the hunger the Muslim is feeling,” observes Tony Young Godswill, national secretary of the Initiative for a Better and Brighter Nigeria, a pro-democracy group. When nationwide anti-government protests broke out in early August, hungry, angry Jos residents from all backgrounds poured into the streets. When Muslim demonstrators knelt to pray on a busy road one Friday afternoon, hundreds of Christian marchers spontaneously formed a tight, protective circle around them. Nigeria’s protests began in response to the soaring costs of food and transport over the past year and a half, which have more than doubled in some cases. Protesters blame the economic stabilization policies of President Bola Tinubu, which have included removing a heavy subsidy on petrol and devaluing the naira, Nigeria’s currency. In Abuja, the capital, Ibrahim Abdullahi was among those who marched. As a Muslim, he says he previously thought it was inappropriate for him to protest against a fellow Muslim like Mr. Tinubu. Now, he held a placard that read “We regret Tinubu.”

Note: Explore more positive stories like this about healing social division.

More than 800 people were selected to participate in the Denver Basic Income Project while they were living on the streets, in shelters, on friends’ couches or in vehicles. They were separated into three groups. Group A received $1,000 per month for a year. Group B received $6,500 the first month and $500 for the next 11 months. And group C, the control group, received $50 per month. About 45% of participants in all three groups were living in a house or apartment that they rented or owned by the study’s 10-month check-in point, according to the research. The number of nights spent in shelters among participants in the first and second groups decreased by half. And participants in those two groups reported an increase in full-time work, while the control group reported decreased full-time employment. Parents of kids under 18 ... reported statistically significant improvements in “parental distress” after receiving money for 10 months. Researchers tallied an estimated $589,214 in savings on public services, including ambulance rides, visits to hospital emergency departments, jail stays and shelter nights. The $9.4 million project was funded by a mix of public and private money, including $1.5 million from The Colorado Trust and $2 million from the city of Denver’s pot of federal pandemic relief money.

Note: Explore more positive stories about reimagining the economy and healing social division.

“Community-owned cooperative real estate” ... was developed a decade ago by a nonprofit legal group and a nonprofit neighborhood group in Oakland, Calif., and has been refined by legal and development groups in Atlanta, Boston, Minneapolis, Philadelphia, Portland, Ore., and other cities. The cooperative strategy enables neighborhood groups to finance unconventional construction or renovation projects that banks and institutional lenders, which prefer strong cash-flow operations, won’t touch. Much of the approach stems from efforts by the federal and local governments to make it easier for small investors to put money into real estate developments. Federal rules once barred small investors — those whose net worth is less than $1 million or who make less than $200,000 a year in income — from participating in development projects; that changed in 2015. At the same time, a few states enacted laws allowing small investors to put their money into local developments. “Until that change, 90 percent of the residents in a community couldn’t make direct investments in a real estate project,” said Chris Miller [with] the National Coalition for Community Capital, a nonprofit group. “Michigan allows nonaccredited investors to invest up to $10,000 in a project now.” In Oakland, the East Bay Permanent Real Estate Cooperative is widely credited with being one of the first community groups to apply the community-owned cooperative concept to a neighborhood project.

Note: Explore more positive stories about reimagining the economy.

“This is the farm,” Sierra Alea said. “This is how to eliminate food waste from landfills,” Alea said. That’s the idea behind Afterlife Ag, the mushroom-growing startup of which she is a co-founder. Winson Wong, another co-founder of Afterlife Ag, said that 80 to 85 percent of what is thrown away in a restaurant is “prep waste, ” material like egg shells, lemon wedges and tomato peels. Afterlife Ag’s model [is] picking up restaurant waste — not the scraps that customers had left on their plates but discards from the chefs who had prepared their meals — and returning with mushrooms. Soon Afterlife Ag was involved in the intricacies of farming and creating substrate in which to grow mushrooms, sometimes with wood chips or shavings from sawmills, sometimes with sawdust from purveyors that smoke fish, sometimes with hemp from hemp farms. “Food waste varies from day to day,” said Aaron Kang, the head grower at Afterlife Ag. Afterlife Ag harvests mushrooms every day and packs them in five-pound boxes for delivery to its restaurant clients. It also sells to schools and hospitals. At one of the restaurants — State Grill and Bar, at 21 West 33rd Street, in the Empire State Building — the chef, Morgan Jarrett, made four dishes with ingredients from Afterlife Ag, starting with a mousse made from pink oyster mushrooms and black king trumpet mushrooms, topped by jangajji, a type of pickled mushroom.

Note: This article is also available here. Explore more positive stories like this on reimagining the economy and healing the Earth.

A time bank does with time what other banks do with money: It stores and trades it. “Time banking means that for every hour you give to your community, you receive an hour credit,” explains Krista Wyatt, executive director of the DC-based nonprofit TimeBanks.Org, which helps volunteers establish local time banks all over the world. Thousands of time banks with several hundred thousand members have been established in at least 37 countries, including China, Malaysia, Japan, Senegal, Argentina, Brazil and in Europe, with over 3.2 million exchanges. There are probably more than 40,000 members in over 500 time banks in the US. Many time banks are volunteer community projects, but the one in Sebastopol, [CA] is funded by the city. “Every volunteer hour is valued around $29,” Wyatt calculates. “Now think about the thousands of dollars a city saves when hundreds of citizens serve their community for free.” The Sebastopol time bank has banked more than 8,000 hours since its launch in 2016. Five core principles ... guide time banks to this day: First, everyone has something to contribute. Second, valuing volunteering as “work.” Third, reciprocity or a “pay-it-forward” ethos. Fourth, community building, and fifth, mutual accountability and respect. “What captured me is that people are doing things out of their own good heart,” Wyatt says. “Many years ago, a woman ... said to [civil rights lawyer] Edgar Cahn, ‘I have nothing to give.’ Edgar Cahn listened and finally responded, ‘You have love to give.’ And the whole room just went silent.” Every hour of service is valued the same, no matter how much skill and expertise a task takes, whether it’s an hour keeping someone company, helping them file their taxes or repair a roof.

Note: Explore more positive stories like this in our comprehensive inspiring news articles archive focused on solutions and bridging divides.

On the outskirts of Austin, Texas, what began as a fringe experiment has quickly become central to the city’s efforts to reduce homelessness. To Justin Tyler Jr., it is home. Mr. Tyler, 41, lives in Community First! Village, which aims to be a model of permanent affordable housing for people who are chronically homeless. In the fall of 2022, he joined nearly 400 residents of the village, moving into one of its typical digs: a 200-square-foot, one-room tiny house furnished with a kitchenette, a bed and a recliner. Eclectic tiny homes are clustered around shared outdoor kitchens, and neat rows of recreational vehicles and manufactured homes line looping cul-de-sacs. There are chicken coops, two vegetable gardens, a convenience store ... art and jewelry studios, a medical clinic and a chapel. In the next few years, Community First is poised to grow to nearly 2,000 homes across three locations, which would make it by far the nation’s largest project of this kind, big enough to permanently house about half of Austin’s chronically homeless population. Many residents have jobs in the village, created to offer residents flexible opportunities to earn some income. Last year, they earned a combined $1.5 million working as gardeners, landscapers, custodians, artists, jewelry makers and more. Ute Dittemer, 66, faced a daily struggle for survival during a decade on the streets before moving into Community First five years ago with her husband. Now she supports herself by painting and molding figures out of clay at the village art house. A few years ago, a clay chess set she made sold for $10,000 at an auction. She used the money to buy her first car.

Note: Explore more positive stories like this in our comprehensive inspiring news articles archive focused on solutions and bridging divides.

Important Note: Explore our full index to key excerpts of revealing major media news articles on several dozen engaging topics. And don't miss amazing excerpts from 20 of the most revealing news articles ever published.