Related Stories

The Working Class Is Paying To Insure Beach Mansions

Key Excerpts from Article on Website of The Lever

Posted: April 1st, 2025

https://www.levernews.com/the-working-class-is-paying-to-ins...

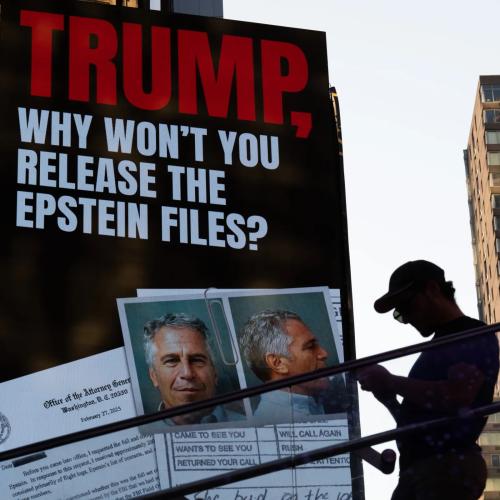

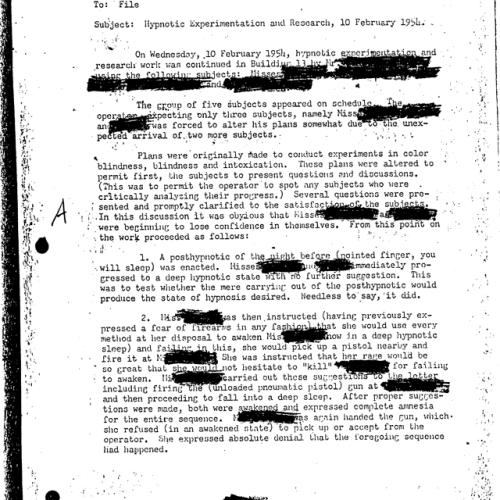

Lawmakers are facing a deadline to reauthorize the federal program providing insurance to homeowners when private insurers abandon their climate-battered locales. The 56-year-old program holds nearly five million policies and more than $22 billion in liabilities. It was envisioned as a stopgap measure for the working class — but the wealthy are now exploiting the program at the expense of low-income homeowners. That includes Trump’s Mar-a-Lago estate. A 2020 study ... found that the program “provides a substantial subsidy to upper-income groups.” How? By charging lower-income households higher premiums than high-income households — even though the latter’s properties are generating far higher loss ratios. The study found that “almost all of the excess (flood) losses are in the highest income segments” because “insufficient premium is collected from the higher income groups.” In other words, “Buyers that can most afford the premium are not paying their proper rate.” Facing the program’s March 14 expiration, lawmakers have been trying again to greenlight it with few reforms. But Sen. Rand Paul (R-Ky.) recently gummed up the works with amendments barring the program from insuring second homes and placing a cap on eligible home values. “Is there some level of rich person’s mansion that maybe the average ordinary taxpayer should not have to subsidize their insurance?” Paul asked.

Note: For more along these lines, read our concise summaries of news articles on financial inequality.

Related Stories

Latest News

Key News Articles from Years Past