Related Stories

How the IRS went soft on billionaires and corporate tax cheats

Key Excerpts from Article on Website of International Consortium of Investigative Journalists

Posted: June 24th, 2024

https://www.icij.org/inside-icij/2024/06/how-the-irs-went-so...

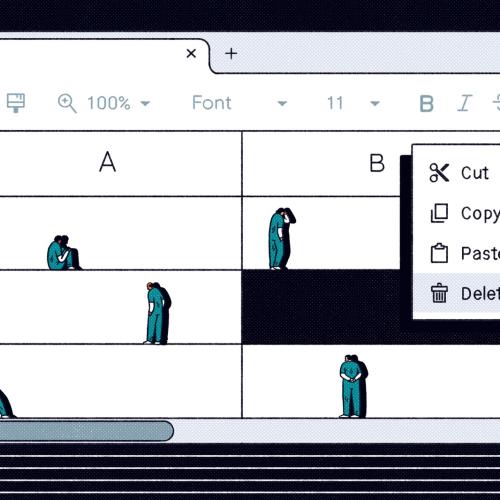

Michael Welu worked at the IRS for decades. During his time at the IRS, he says, upper management in the division tasked with auditing large corporations and ultrawealthy people — the Large Business and International Division — was quick to dismiss any suggestion that a powerful taxpayer may have committed a crime, and commonly discouraged frontline agents from pursuing big cases. This stood in deep contrast to the office that policed small businesses and self-employed people, which was empowered to ... take an appropriately firm stance toward taxpayers breaking the law. “I was putting butchers, bakers and candlestick makers in jail, but the big stuff we really wanted to go after was being ignored,” Welu told the International Consortium of Investigative Journalists. “It could be the most egregious, ridiculous scheme and they were just not interested.” Over the past five years, [the Large Business and International Division] flagged no more than 22 instances of possible tax crimes for the agency’s criminal investigators to review further — out of trillions of dollars in annual income from large corporations and ultrawealthy people that the office oversees. During the same five years, the IRS office that covers small businesses and self-employed people flagged roughly 40 times more possible crimes, sending criminal investigators 848 referrals. The IRS says the amount of U.S. taxes left uncollected could exceed $600 billion per year.

Note: According to The Guardian, "Thirty-nine of the S&P 500 or Fortune 500 paid no federal income tax at all from 2018 to 2020 while reporting a combined $122bn in profits to their shareholders." For more along these lines, see concise summaries of deeply revealing news articles on government corruption and income inequality from reliable major media sources.

Related Stories

Latest News

Key News Articles from Years Past