Banking Bailout News Stories

Below are key excerpts of revealing news articles on the 2008 banking bailout from reliable news media sources. If any link fails to function, a paywall blocks full access, or the article is no longer available, try these digital tools.

Few countries blew up more spectacularly than Iceland in the 2008 financial crisis. The local stock market plunged 90 percent; unemployment rose ninefold; inflation shot to more than 18 percent; the countrys biggest banks all failed. Since then, Iceland has turned in a pretty impressive performance. It has repaid International Monetary Fund rescue loans ahead of schedule. Growth this year will be about 2.5 percent, better than most developed economies. Unemployment has fallen by half. Icelands approach was the polar opposite of the U.S. and Europe, which rescued their banks and did little to aid indebted homeowners. Nothing distinguishes Iceland as much as its aid to consumers. To homeowners with negative equity, the country offered write-offs that would wipe out debt above 110 percent of the property value. The government also provided means-tested subsidies to reduce mortgage-interest expenses: Those with lower earnings, less home equity and children were granted the most generous support. In June 2010, the nations Supreme Court gave debtors another break: Bank loans that were indexed to foreign currencies were declared illegal. Because the Icelandic krona plunged 80 percent during the crisis, the cost of repaying foreign debt more than doubled. The ruling let consumers repay the banks as if the loans were in krona. These policies helped consumers erase debt equal to 13 percent of Icelands $14 billion economy. Now, consumers have money to spend on other things.

Note: For deeply revealing reports from reliable major media sources on the collusion of most major governments with the financial sector whose profiteering contributed to the global economic crisis, click here.

When the people of Greece saw their democratically elected Prime Minister George Papandreou forced out of office in November of 2011 and replaced by an unelected Conservative technocrat, Lucas Papademos, most were unaware of the bigger picture of what was happening. Most of us in the United States were [equally] ignorant when, in 2008, [Congress] voted yes at the behest of Bush's Treasury Secretary Henry Paulsen and jammed through the biggest bailout of Wall Street in our nations history. But now, as the Bank of England ... announces that former investment banker Mark Carney will be its new chief, we cant afford to ignore whats happening around the world. Steadily and stealthily Goldman Sachs is carrying out a global coup detat. Theres one tie that binds Lucas Papademos in Greece, Henry Paulsen [and Timothy Geithner] in the United States, and Mark Carney in the U.K., and thats Goldman Sachs. All were former bankers and executives at the Wall Street giant, all assumed prominent positions of power, and all played a hand after the global financial meltdown of 2007-08, thus making sure Goldman Sachs weathered the storm and made significant profits in the process. As Europe descends [into] economic crisis, Goldman Sachs's people are managing the demise of the continent. As the British newspaper The Independent reported earlier this year, the Conservative technocrats currently steering or who have steered post-crash fiscal policy in Greece, Germany, Italy, Belgium, France, and now the UK, all hail from Goldman Sachs. In fact, the head of the European Central Bank itself, Mario Draghi, was the former managing director of Goldman Sachs International.

Note: Once again truth-out.org carries this important article and vital information which no major media has covered. Strangely, the entire website went down for a while not long after the article was published. If the article cannot be found at the link above, click here. For deeply revealing reports from reliable major media sources on financial corruption, click here.

The ascension of Mario Monti to the Italian prime ministership is remarkable for more reasons than it is possible to count. By imposing rule by unelected technocrats, [Italy] has suspended the normal rules of democracy, and maybe democracy itself. And by putting a senior adviser at Goldman Sachs in charge of a Western nation, it has taken to new heights the political power of an investment bank that you might have thought was prohibitively politically toxic. The European Central Bank ... is under ex-Goldman management, and the investment bank's alumni hold sway in the corridors of power in almost every European nation, as they have done in the US throughout the financial crisis. Even before the upheaval in Italy, there was no sign of Goldman Sachs living down its nickname as "the Vampire Squid", and now that its tentacles reach to the top of the eurozone, sceptical voices are raising questions over its influence. Simon Johnson, the former International Monetary Fund economist, in his book 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown, argued that Goldman Sachs and the other large banks had become so close to government in the run-up to the financial crisis that the US was effectively an oligarchy. At least European politicians aren't "bought and paid for" by corporations, as in the US, he says. "Instead what you have in Europe is a shared world-view among the policy elite and the bankers, a shared set of goals and mutual reinforcement of illusions." This is The Goldman Sachs Project. Put simply, it is to hug governments close.

Note: For revealing major media articles on key secret societies which manipulate global politics, click here. For deeply revealing reports from reliable major media sources on financial corruption, click here.

The system of so-called "shadow banking" ... grew to a new high of $67 trillion globally last year, a top regulatory group said, calling for tighter control of the sector. A report by the Financial Stability Board (FSB) [states] that shadow banking is set to thrive, beyond the reach of a regulatory net tightening around traditional banks and banking activities. The FSB, a task force from the world's top 20 economies, also called for greater regulatory control of shadow banking. The study by the FSB said shadow banking around the world more than doubled to $62 trillion in the five years to 2007 before the crisis struck. But the size of the total system had grown to $67 trillion in 2011 more than the total economic output of all the countries in the study. The multitrillion-dollar activities of hedge funds and private equity companies are often cited as examples of shadow banking. But the term also covers investment funds, money market funds and even cash-rich firms that lend government bonds to banks, which in turn use them as security when taking credit from the European Central Bank. The United States had the largest shadow banking system, said the FSB, with assets of $23 trillion in 2011, followed by the euro area with $22 trillion and the United Kingdom at $9 trillion.

Note: That's $10,000 for every man, woman, and child on the planet. Do you think the bankers are somehow manipulating the system? For deeply revealing reports from reliable major media sources on financial corruption, click here.

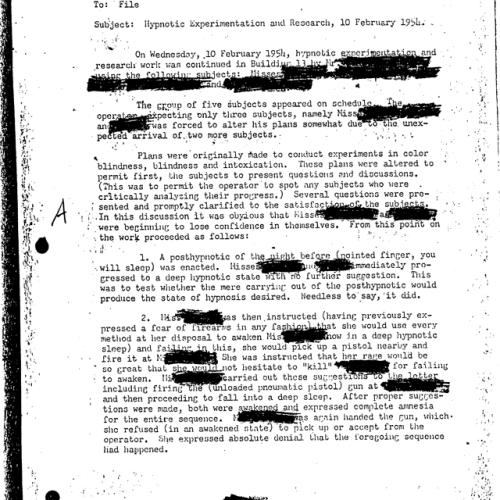

Move over, adulterous generals. It might be time to make way for a new sexual rats' nest at America's top financial police agency, the SEC. In a salacious 77-page complaint ... David Weber, the former chief investigator for the SEC Inspector General's office, accuses the SEC of retaliating against Weber for coming forward as a whistleblower. According to this lawsuit, Weber was made a target of [retaliation] after he came forward with concerns that his bosses may have been spending more time copulating than they were investigating the SEC. Weber claims that in recent years, while the SEC Inspector General's office has been attempting to investigate the agency's seemingly-negligent responses in such matters as the Bernie Madoff case and the less-well-known (but nearly as disturbing) Stanford Financial Ponzi scandal, two of the IG office's senior officials former Inspector General David Kotz and his successor, Noelle Maloney were sleeping together. Weber also claims that Kotz was also having an affair with a lawyer representing a key group of Stanford victims, a Dr. Gaytri Kachroo. Weber claims that Maloney last year refused to meet with Kachroo as part of the Stanford investigation. By then, Kotz had stepped down as SEC IG and Maloney had replaced him as Acting IG. Weber was fired on October 31st. Apparently he has decided not to take the firing quietly. "When David Weber began to uncover the depth of dysfunction at the SEC, they fired him," his attorney Cary Hansel said. "He has no intention of being silenced by threats and false allegations."

Note: We don't normally use Rolling Stone as a source, but this important story has not been covered elsewhere in the major media.

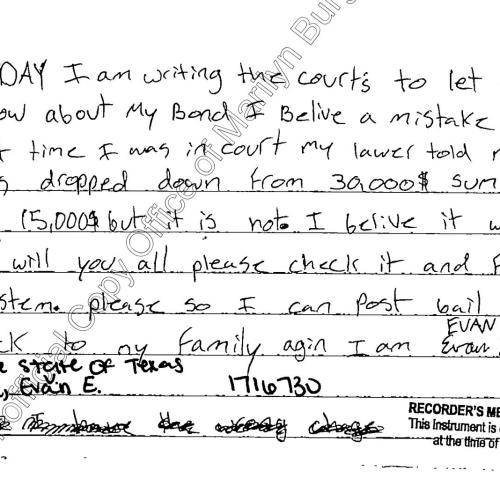

Spire Law Group's national home owners' lawsuit [is] the largest money laundering and racketeering lawsuit in United States history, identifying $43 trillion of laundered money. [In] the federal lawsuit now [pending] in the United States District Court in Brooklyn, New York ... plaintiffs now establish the location of the $43 trillion of laundered money in a racketeering enterprise. [The] mass tort action [seeks] to halt all foreclosures nationwide pending the return of the $43 trillion, an audit of the Fed and audits of all the "bailout programs." The epicenter of this laundering and racketeering enterprise has been and continues to be Wall Street and continues to involve the very "Banksters" located there who have repeatedly asked in the past to be "bailed out" and to be "bailed out" in the future. The Havens for the money laundering schemes ... are located in such venues as Switzerland, the Isle of Man, Luxembourg, Malaysia, Cypress and [other entities] identified in both the United Nations and the U.S. Senate's recent reports on international money laundering. The case further alleges that through these obscure foreign companies, Bank of America, J.P. Morgan, Wells Fargo Bank, Citibank, Citigroup, One West Bank, and numerous other federally chartered banks stole trillions of dollars of home owners' and taxpayers' money during the last decade and then laundered it through offshore companies.

Note: CNBC also reported this astonishing news. Yet within hours the original page for the article was taken down, and CNBC senior vice president Kevin Krim received news that his children were killed under very suspicious circumstances. Could this have been a strong warning? For more in this, click here. For deeply revealing reports from reliable major media sources on financial corruption, click here.

The Occupy movement received vindication from an unlikely source tonight, as a senior executive at the Bank of England credited it with stirring a reformation of finance. Andrew Haldane, executive director of financial stability, said Occupy protesters had been both loud and persuasive, and had attracted public support because they are right. Some have suggested that Occupys voice has been loud but vague, long on problems, short on solutions. Others have argued that the fault-lines in the global financial system, which chasmed during the crisis, are essentially unaltered, that reform has failed, Mr Haldane said. I wish to argue that both are wrong that Occupys voice has been both loud and persuasive and that policymakers have listened and are acting in ways which will close those fault-lines. In fact, I want to argue that we are in the early stages of a reformation of finance, a reformation which Occupy has helped stir. Speaking at an Occupy Economics event in central London, Mr Haldane said that Occupy had been successful in its efforts to popularise the problems of the global financial system for one very simple reason: they are right. He added that protesters ... touched a moral nerve in pointing to growing inequities in the allocation of wealth. Mr Haldane ended with a direct appeal to activists to continue putting pressure on governments and regulators. He said: You have put the arguments. You have helped win the debate. And policymakers, like me, will need your continuing support in delivering that radical change.

Note: For deeply revealing reports from reliable major media sources on financial corruption, click here.

BILL MOYERS: Why do some of the most powerful and privileged people in the country get a free lunch you pay for? You'll find some of the answers [in]: Free Lunch: How the Wealthiest Americans Enrich Themselves at Government Expense (and Stick You with the Bill). The theme of the book as I read it is that not that the rich are getting richer but that they've got the government rigging the rules to help them do it. DAVID CAY JOHNSTON: That's exactly right. And they're doing it in a way that I think is very crucial for people to understand. They're doing it by taking from those with less to give to those with more. We gave $100 million dollars to Warren Buffett's company last year, a gift from the taxpayers. We make gifts all over the place to rich people. Donald Trump benefits from a tax specifically levied by the State of New Jersey for the poor. Part of the casino winnings tax in New Jersey is dedicated to help the poor. But $89 million of it is being diverted to subsidize Donald Trump's casino's building retail space. George Steinbrenner, like almost every owner of a major sports franchise, gets enormous public subsidies. The major sports franchises [make] 100 percent of their profits from subsidies. In fact, if it weren't for these subsidies, the baseball, football, hockey, and basketball enterprises as a whole would be losing hundreds of millions of dollars a year. George Bush owes almost his entire fortune to a tax increase that was funneled into his pocket and into the use of eminent domain laws to essentially legally cheat other people out of their land for less than it was worth to enrich him and his fellow investors.

Note: Watch part of this amazingly revealing interview online at this link. Johnston is a prolific writer with the NY Times; to see a list of his many articles there, click here. For deeply revealing reports from reliable major media sources on financial corruption, click here.

Journalist Chrystia Freeland has spent years reporting on the people who've reached the pinnacle of the business world. For her new book, Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else, she traveled the world, interviewing the multimillionaires and billionaires who make up the world's elite super-rich. Those at the very top, Freeland says, have told her that American workers are the most overpaid in the world, and that they need to be more productive if they want to have better lives. "It is a sense of, you know, 'I deserve this,' " she says. "I do think that there is both a very powerful sense of entitlement and a kind of bubble of wealth which makes it hard for the people at the very top to understand the travails of the middle class." How are the super-rich ... different from the super-rich of the past say, 1955? Well, there are many more of them, and they're a lot richer than they used to be. "One of the things which is really astonishing is how much bigger the gap is than it was before," she says. "In the 1950s, America was relatively egalitarian, much more so than compared to now." CEOs earn exponentially more now, compared with their workers, than they did 60 years ago. Freeland says she's worried about what she calls an inevitable human temptation that people who've benefited from a mobile society, like America, will get to the top and then rig the rules to benefit themselves." You don't do this in a kind of chortling, smoking your cigar, conspiratorial thinking way," she says. "You do it by persuading yourself that what is in your own personal self-interest is in the interests of everybody else.

Note: For a fascinating excerpt from this book, click here. For revealing major media articles showing the stark gap between the uber-rich and the rest of us, click here.

Branko Milanovic is an economist at the World Bank. He first became interested in income inequality studying for his PhD in the 1980s in his native Yugoslavia, where he discovered it was officially viewed as a "sensitive" subject which meant one the ruling regime didn't want its scholars to look at too closely. But when Milanovic moved to Washington, he discovered a curious thing. Americans were happy to celebrate their super-rich and, at least sometimes, worry about their poor. But putting those two conversations together and talking about economic inequality was pretty much taboo. "I was once told by the head of a prestigious think tank in Washington, D.C., that the think tank's board was very unlikely to fund any work that had income or wealth inequality in its title," Milanovic ... explained in a recent book. "Yes, they would finance anything to do with poverty alleviation, but inequality was an altogether different matter." "Why?" he asked. "Because 'my' concern with the poverty of some people actually projects me in a very nice, warm glow: I am ready to use my money to help them. Charity is a good thing; a lot of egos are boosted by it and many ethical points earned even when only tiny amounts are given to the poor. But inequality is different: Every mention of it raises in fact the issue of the appropriateness or legitimacy of my income." When the discussion shifts from celebratory to analytical, the super-elite get nervous.

Note: Excerpted from Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else by Chrystia Freeland. For revealing major media articles showing the stark gap between the uber-rich and the rest of us, click here.

In the early 14th century, Venice was one of the richest cities in Europe. By 1500, Venices population was smaller than it had been in 1330. In the 17th and 18th centuries, as the rest of Europe grew, the city continued to shrink. The story of Venices rise and fall is told by the scholars Daron Acemoglu and James A. Robinson, in their book Why Nations Fail: The Origins of Power, Prosperity, and Poverty, as an illustration of their thesis that what separates successful states from failed ones is whether their governing institutions are inclusive or extractive. Extractive states are controlled by ruling elites whose objective is to extract as much wealth as they can from the rest of society. Inclusive states give everyone access to economic opportunity; often, greater inclusiveness creates more prosperity, which creates an incentive for ever greater inclusiveness. The history of the United States can be read as one such virtuous circle. But as the story of Venice shows, virtuous circles can be broken. Elites that have prospered from inclusive systems can be tempted to pull up the ladder they climbed to the top. Eventually, their societies become extractive and their economies languish. That ... is the danger America faces today, as the 1 percent pulls away from everyone else and pursues an economic, political and social agenda that will increase that gap even further ultimately destroying the open system that made America rich and allowed its 1 percent to thrive in the first place.

Note: The author of this article, Chrystia Freeland, wrote the book Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else, from which this essay is adapted. For deeply revealing reports from reliable major media sources on income inequality, click here.

Attorneys for jailed former Swiss banker Bradley Birkenfeld announced [on September 11] that the IRS will pay him $104 million as a whistleblower reward for information he turned over to the US government. The information Birkenfeld revealed detailed the inner workings of the secretive private wealth management division of the Swiss bank UBS, where the American-born Birkenfeld helped his US clients evade taxes by hiding wealth overseas. Tuesday's announcement represents an astonishing turn of fortune for Birkenfeld, who was released from federal prison in August after serving 31 months on charges relating to his efforts to help a wealthy client avoid taxes. Birkenfeld attorney Stephen Kohn said the information the former Swiss banker turned over to the IRS led directly to the $780 million fine paid to the US by his former employer, UBS, as well as leading over 35,000 taxpayers to participate in amnesty programs to voluntarily repatriate their illegal offshore accounts. That resulted in the collection of over $5 billion dollars in back taxes, fines and penalties that otherwise would have remained outside the reach of the government. Birkenfeld's disclosures also led to the first cracks in the legendarily secretive Swiss banking system, and ultimately the Swiss government changed its tax treaty with the United States. UBS turned over the names of more than than 4,900 U.S. taxpayers who held illegal offshore accounts. Investigations into those accounts are ongoing.

Note: For deeply revealing reports from reliable major media sources on the collusion between financial corporations and government regulators, click here.

When the Justice Department recently closed its criminal investigation of Goldman Sachs, it became all but certain that no major American banks or their top executives would ever face criminal charges for their role in the financial crisis. Justice officials and even President Obama have defended the lack of prosecutions, saying that even though greed and other moral lapses were evident in the run-up to the crisis, the conduct was not necessarily illegal. But that characterization of the financial industry's actions has always defied common sense - and all the more so now that a fuller picture is emerging of the range of banks' reckless and lawless activities, including interest-rate rigging, money laundering, securities fraud and excessive speculation. The financial crisis, fomented over years by big banks and presided over by executives, involved reckless lending, heedless securitizations, exorbitant paydays and illusory profits, all of which led to government bailouts and economic calamity. Is it plausible that none of that broke the law and that none of the people in positions of power and authority knew what was going on? The statute of limitations, generally five years for securities fraud and most other federal offenses, is running out, precluding the possibility of bringing many new suits dating from the bubble years. The result is a public perception that the big banks and their leaders will never have to answer fully for the crisis. The shameless pursuit of Wall Street campaign donations by both political parties strengthens this perception, and further undermines confidence in the rule of law.

Note: For deeply revealing reports from reliable major media sources on the collusion between government and the big banks, click here.

For the last year, whistle-blowers deep inside corporate America have been dishing dirt on their employers under a U.S. Securities and Exchange Commission program that could give them a cut of multimillion-dollar penalties won by financial regulators. A new bounty program has been an intelligence boon to the securities industry regulator, which has struggled to redeem itself after failing to stop Bernard Madoff's epic Ponzi scheme and rein in Wall Street before the 2008 financial crisis. Motivated by cash and the chance to rat out wrongdoers, tipsters are dropping more than names. Whistle-blowers and their attorneys are turning over boxes of documents, copies of emails and even audio recordings of alleged fraud or illegal overseas bribery. "We are getting very, very high-quality information from whistle-blowers," said Sean McKessy, director of the SEC's whistle-blower office. In the program's first year, 2,870 tips or about eight a day rolled in as of Aug. 12. And on Tuesday, one of them finally led to the agency's first payout: $50,000 to an informant who alerted regulators to an investment fraud. They declined to specify the case, careful to avoid identifying the whistle-blower. Some say shielding identities could pose a challenge for publicizing the program, but the anonymity probably will yield more information. The flood of new information doesn't necessarily mean the SEC will be more effective. In the case of Madoff, one whistle-blower repeatedly sounded the alarm years before the scheme blew up to no avail.

Note: For deeply revealing reports from reliable major media sources on the collusion between government and the big banks, click here.

"I believe that banking institutions are more dangerous to our liberties than standing armies." - Thomas Jefferson, 1816. When Thomas Jefferson spoke those words, banks were local and very small compared with the financial behemoths of today. Banks are more dangerous now than in Jefferson's time, and they are totally out of control. During the Depression of the 1930s, President Franklin Roosevelt referred to banks as the "money changers in the temple of our civilization," and little has been done since. It is well past the time that people on Wall Street live by the rule of law - not just pay fines - and some executives go to jail for their conduct. In 2008, the much-publicized Troubled Assets Relief Program bailed out banks and Wall Street to the tune of $700 billion with taxpayer money. While the banks were bailed out of the trouble they caused, they continued to pay out enormous executive bonuses with taxpayers' money in multimillion-dollar year-end gifts. JPMorgan received $25 billion from the government in 2008 and gave out nearly $9 billion in bonus money that year. When the derivative-driven housing market collapsed in 2008, Citigroup and Bank of America, the major banks in that market, and eight other top Wall Street firms got $1.2 trillion in then-secret loans of taxpayer money from the Federal Reserve. The Fed even went to court in an attempt to hide the identities of those banks from the public. Regulating the banks and bringing the rule of law to Wall Street banks is necessary now. Sending a few Wall Street banksters to jail would stop some of the abuse as well.

Note: For deeply revealing reports from reliable major media sources on the corrupt relationship between government and the financial sector, click here.

Money laundering. Price fixing. Bid rigging. Securities fraud. Talking about the mob? No, unfortunately. Wall Street. These days, the business sections of newspapers read like rap sheets. GE Capital, JPMorgan Chase, UBS, Wells Fargo and Bank of America tied to a bid-rigging scheme to bilk cities and towns out of interest earnings. ING Direct, HSBC and Standard Chartered Bank facing charges of money laundering. Barclays caught manipulating a key interest rate, costing savers and investors dearly, with a raft of other big banks also under investigation. Not to speak of the unprecedented wrongdoing that precipitated the financial crisis of 2008. Yet, it's clear that the unrepentant and the unreformed are still all too present within our banking system. A June survey of 500 senior financial services executives in the United States and Britain turned up stunning results. Some 24 percent said that they believed that financial services professionals may need to engage in illegal or unethical conduct to succeed, 26 percent said that they had observed or had firsthand knowledge of wrongdoing in the workplace, and 16 percent said they would engage in insider trading if they could get away with it. That too much of Wall Street remains unchanged is not surprising. Simply stated, the banks and their leaders have paid no real economic, legal or political price for their wrongdoing and thus have not felt compelled to change.

Note: The author of this article, Phil Angelides, is a former state treasurer of California and the chairman of the Financial Crisis Inquiry Commission. For deeply revealing reports from reliable major media sources on the corrupt relationship between government and the financial sector, click here.

How much is democracy worth to you? If youre like most people, its priceless. But for the hedge funds and insurance companies on Wall Street, it does have a price tag: approximately $4.2 billion. Thats how much the Finance, Insurance, and Real Estate (F.I.R.E.) sector has invested in political influence through campaign contributions and lobbying since 2006. That comes to $1,331 a minute spent on political power. The new report is called Meet the F.I.R.E. Sector: How Wall Street Is Burning Democracy. It was developed by Elect Democracy, a nonpartisan effort ... to expose and challenge the impact of corporate money in U.S. politics. The report ... analyzes exactly how Wall Street has secured ... industry-loyal voting practices in Congress: by shoveling stacks of campaign cash in the direction of Congressional hopefuls from both major political parties. That money lets these industries get what they want in Washington. The F.I.R.E. sector contributed $879 million to members of Congress since 2006, and took positions on 383 bills during the 112th Congress. For instance, they supported Free Trade Agreements with Korea, Panama, and Colombia in 2007, and backed the bailout in 2008. Bills they opposed include the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2009, the Limited Homeowner and Investor Loss in Foreclosure Act of 2010, and the Stop Student Loan Interest Rate Hike Act of 2011. At every turn, the F.I.R.E. sector demands special treatment for Wall Street while consumers, homeowners, and students get stuck with the bills.

Note: Though not a major media source, Yes! Magazine is one of the very few media working towards positive, sustainable solutions to the problems of our world. For deeply revealing reports from reliable major media sources on the corrupt relationship between government and the financial sector, click here.

Who's buying our democracy? Wall Street financiers, the Koch brothers, and casino magnates Sheldon Adelson and Steve Wynn, among others. And they're doing much of it in secret. It's a perfect storm - the combination of three waves that are about to drown government as we know it. The first is the greatest concentration of wealth in America in more than a century. The 400 richest Americans are richer than the bottom 150 million Americans put together. The trend started 30 years ago, and it's related to globalization and technological changes that have stymied wage growth for most people, "trickle-down economics," ... tax cuts and the steady decline in the bargaining power of organized labor. The second is the wave of unlimited political contributions, courtesy of ... one of the worst decisions in Supreme Court history, Citizens United vs. Federal Election Commission, the 2010 ruling that held that corporations are people under the First Amendment, [meaning] that virtually any billionaire can contribute as much to a political campaign as he wants. The third is complete secrecy about who's contributing how much to whom. Political fronts posing as charitable, nonprofit "social welfare" organizations ... don't have to disclose their donors. As a result, outfits like the Chamber of Commerce and Karl Rove's Crossroads GPS are taking in hundreds of millions from corporations that don't even tell their own shareholders what political payments they're making. Separately, any one of these three would be bad enough. Put the three together, and our democracy is being sold down the drain.

Note: The author of this article, Robert Reich, is a professor of public policy at UC Berkeley and former U.S. secretary of labor, and author of the newly released Beyond Outrage: What Has Gone Wrong With Our Economy and Our Democracy, and How to Fix It.

On [August 9] the Department of Justice announced it will not prosecute Goldman Sachs or any of its employees in a financial-fraud probe. Despite the Obama administrations promises to clean up Wall Street in the wake of Americas worst financial crisis, there has not been a single criminal charge filed by the federal government against any top executive of the elite financial institutions. Why is that? In a word: cronyism. Take Goldman Sachs, for example. In 2008, Goldman Sachs employees were among Barack Obamas top campaign contributors, giving a combined $1,013,091. [Attorney General] Eric Holders former law firm, Covington & Burling, also counts Goldman Sachs as one of its clients. Furthermore, in April 2011, when the Senate Permanent Subcommittee on Investigations issued a scathing report detailing Goldmans suspicious Abacus deal, several Goldman executives and their families began flooding Obama campaign coffers with donations, some giving the maximum $35,800. The individuals the DOJs Financial Fraud Enforcement Task Force has placed in its prosecutorial crosshairs seem shockingly small compared with the Wall Street titans the Obama administration promised to bring to justice. To be sure, financial fraud of any kind is wrong and should be prosecuted. But locking up pygmies is hardly the kind of financial-fraud crackdown Americans expected in the wake of the largest financial crisis in U.S. history. Increasingly, there appear to be two sets of rules: one for the average citizen, and another for the connected cronies who rule the inside game.

Note: For deeply revealing reports from reliable major media sources on financial corporations' control over government, see our Banking Bailout archive here.

Kevin Ferry: There are Libor subpoenas raining down on the New York branches of these foreign banks today. So I think you really have to watch it. The [British Bankers' Association] is now saying they are going to go into overhaul mode. So as if we dont have enough things going on, youre going to start opening up a Pandoras Box here in the Libor sector of the market. I think what theyre going to do ... is basically put the old system in a coma, and work to devise something thats a little bit better, and its going to be tricky. Doug Dachille: So what are they going to do with the euro/dollar futures and all the outstanding notion of principal of contracts linked to Libor? I mean is everybody going to convert their Libor interest rate swaps to cost of fund funds or Fed fund basis swaps or some other index? KF: Are you asking me? Ive asked that question as high as I could ask it and I get blank stares. DD: Its not clear that every bank has exactly the same Libor exposure, so its not clear that that cartel, in setting Libor and manipulating it, actually is as powerful as the cartel that manages oil prices. Yet I dont hear any outrage of people routinely trading commodity derivatives and commodity futures, as much as I hear the outrage over euro/dollar futures and Libor-based interest rate swaps. Everybody assumes thats what goes on when you trade commodity futures, but nobody ever really thought that was going on when you were trading euro/dollar futures.

Note: The text above is an excerpt from a CNBC news video. Click on the link above for the full report. For deeply revealing reports from reliable major media sources on corruption in the financial sector, click here.

Important Note: Explore our full index to revealing excerpts of key major media news stories on several dozen engaging topics. And don't miss amazing excerpts from 20 of the most revealing news articles ever published.